This article will tell you about the FundKash Loan App. If you are considering taking a loan from FundKash, this article can be helpful for you. In today’s digital age, getting a loan through a mobile app has become quite easy, but there are also some fraudulent mobile loan apps in the market. Therefore, it is important to learn about any loan application before taking a loan from it. By reading this article, you can learn how to get a loan from the FundKash app and whether the FundKash loan app is genuine or fake.

What is Fundkash?

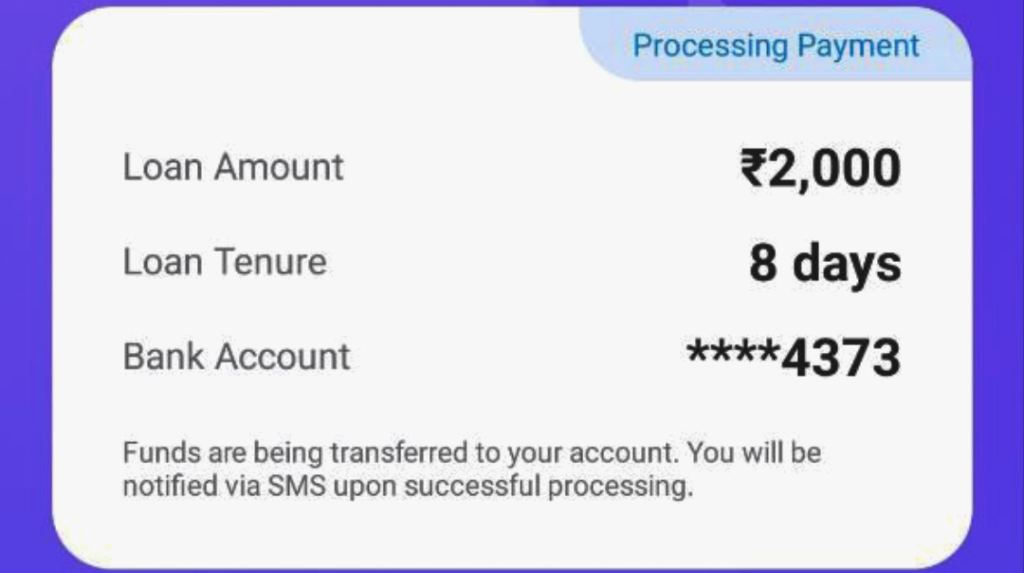

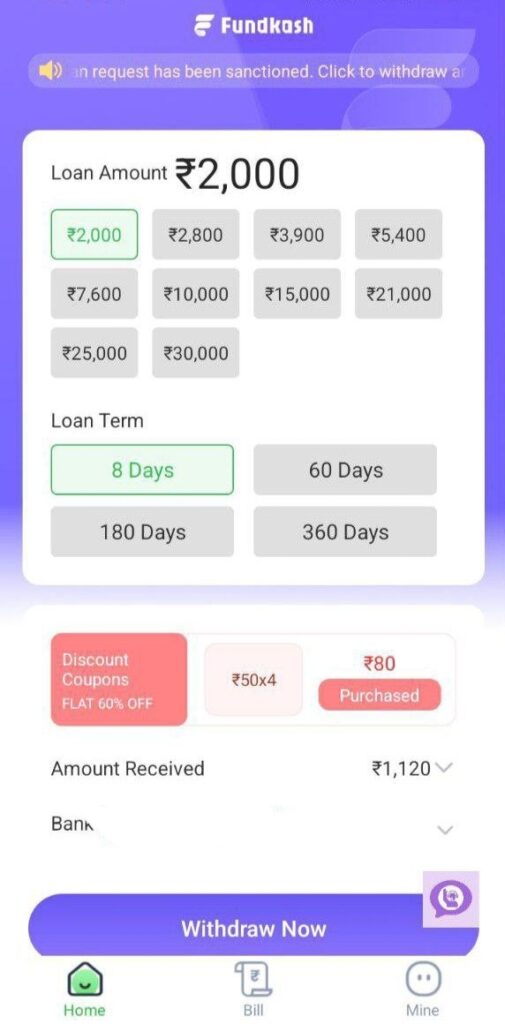

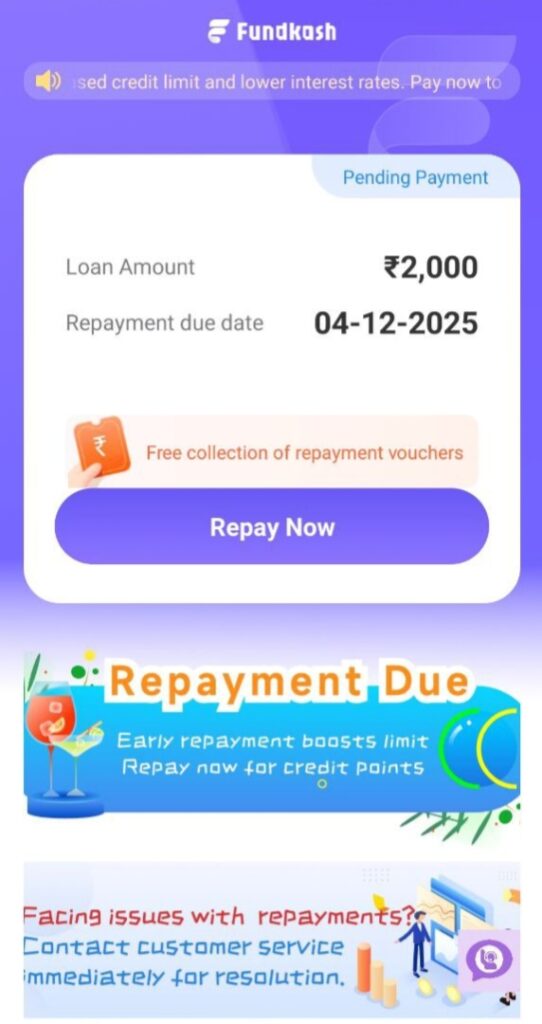

FundKash is a loan platform that claims to offer loans up to ₹80,000 using Aadhaar and PAN cards. However, after applying for a loan through this application, we found that it only provides a loan of ₹2,000, which must be repaid within 8 days. Of this amount, only ₹1,120 is deposited into your bank account, and you are required to repay ₹2,000 after 8 days.

For example:

- Loan amount: ₹2000

- Loan tenure: 8 days

- Interest and processing fees: ₹880

- Bank disbursement amount: ₹1120

- Total repayment amount: ₹2000

Common complaints about FundKash

- High interest rates and hidden fees – The most common complaint is that the total cost of the loan offered by the app is significantly higher than the amount received. Some users also claim that the Fund Kash Loan App is simply a trap designed to ensnare borrowers in a cycle of processing fees and exorbitant interest.

- Threatening calls and aggressive recovery – Some users report that the Fund Kash Loan App makes threatening calls if payment is not made within 8 days. These threats include hacking into your phone to access your contact list, stealing all your photos from your gallery, and even threatening to share nude photos – all to pressure you into repaying the loan.

- Loan amount and loan tenure – When applying for a loan for the first time through the Fund Kash Loan App, you will only receive ₹1120 in your bank account, even though the loan amount is stated as ₹2000. You will then be required to repay the full ₹2000 within an 8-day loan period.

Things to keep in mind when taking out a loan

- Transparency and Priority

Choose loan apps that provide transparent information and clear contact details for customer support. - Be cautious of permissions

When applying for a loan through any loan application, be wary of apps that request excessive permissions, such as access to your contacts or gallery. They may misuse this information. - Verify registration

Before applying for a loan, ensure that the loan application is registered with the RBI (Reserve Bank of India).

Hidden fees: Carefully review all terms and conditions, interest rates, and fees before accepting a loan offer. - Advance fees

Do not apply for a loan through any application that attempts to collect an advance payment before disbursing the loan amount.

Fund Kash Loan App: Real or Fake?

As we know, the FundKash Loan App is not registered with the Reserve Bank of India (RBI), and the claims made by this application are completely false. It offers a loan of ₹2000 for only 8 days, which clearly indicates that this application is designed solely to trap users in a cycle of interest and processing fees. This application is fake.

Furthermore, this loan application claims to provide a ₹2000 loan without checking your CIBIL score, but no RBI-registered loan app provides a loan without checking the CIBIL score.

Note: This article is for informational purposes only. Always take loans only from RBI-registered loan apps.

FAQs

How to download the FundKash Loan App?

This loan application is not available on the Google Play Store. You can download the FundKash APK.

Is the FundKash Loan App safe?

After taking a loan from FundKash, we found that this loan application only works to trap people in a processing fee scam.

What happens if I don’t repay the FundKash loan?

Not repaying the FundKash loan can be harmful to you. They may call all the contact numbers on your mobile phone, hack all the photos in your mobile gallery, and it could be harmful to your personal data.