This article will tell you about SalaryOnTime Loans. If you need money urgently and are considering taking a loan from SalaryOnTime, this article can be helpful. You can get a personal loan from SalaryOnTime ranging from ₹8,000 to ₹100,000, with a loan tenure of 365 days. However, it’s essential to analyze any loan platform before taking out a loan. Read this article to understand the complete process of getting a SalaryOnTime loan before applying.

What is SalaryOnTime?

SalaryOntime is an online loan platform developed by Kasar Credit & Capital Pvt. Ltd. This loan app provides paperless personal loans in India, which can be useful for emergency expenses such as travel, education, or other needs. Kasar Credit & Capital Pvt. Ltd. is a non-banking financial company registered with the Reserve Bank of India.

Key features of Salaryontime Loan

- Loan amount: ₹8,000 to ₹1,00,000

- Repayment period: 90 to 365 days

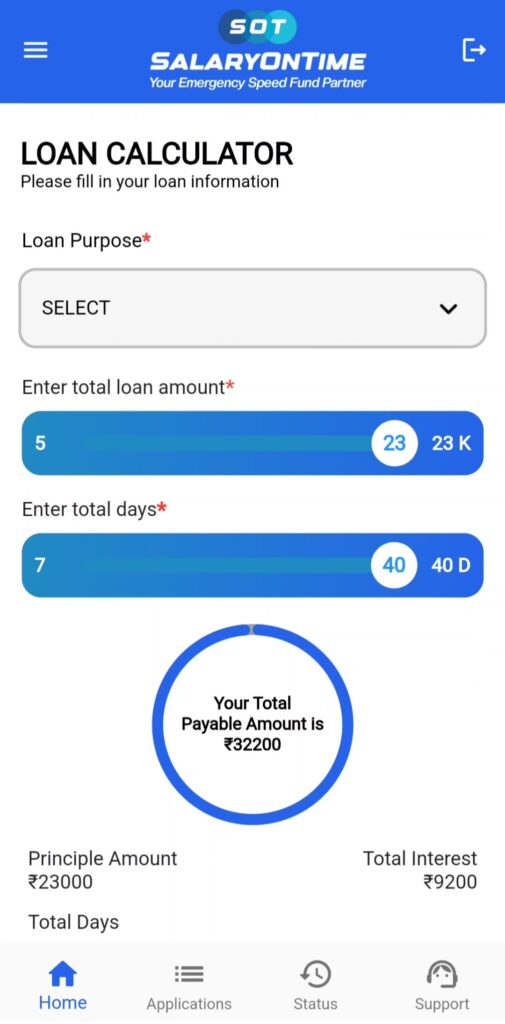

- Interest rate: Up to 3% per month, which can be up to 42.576% Annual Percentage Rate (APR)

- Processing fee: 0% to 10% of the loan amount

- No collateral required: Loans available without any security

- 100% digital process: The entire process is online and paperless

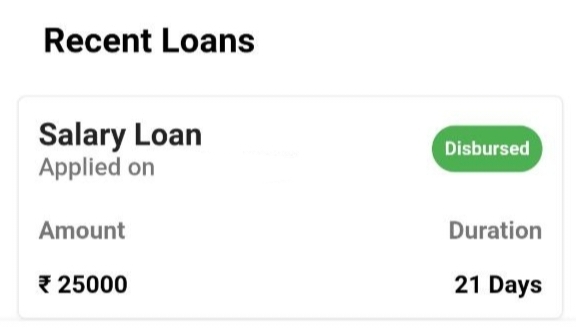

- Instant loan approval and disbursement: Loan approved and amount disbursed in minutes

Required documents

- The loan application must be completely filled out with your current photograph.

- Aadhaar card is mandatory.

- PAN card is mandatory.

- Proof of address: Driving license, Voter ID, Passport, Utility bill (electricity/water/gas), Postpaid/Landline bill.

- Bank statements for the last 3 months of your salary account.

- Salary slips for the last 3 months.

Eligibility Criteria

- Must be an Indian resident.

- Must be a salaried employee of a reputable MNC, private, or public limited company.

- Must have a good CIBIL score.

- This short-term loan service is only available to salaried individuals with a monthly salary of more than INR 30,000.

Salaryontime Loan Application Process

To apply for a Salaryontime Loan, follow all the steps given below:

- First, go to https://salaryontime.com/

- Complete registration with your mobile number

- Fill in your basic details

- Upload all required documents

- Submit the loan application form

- After submitting the application form, you may receive a call for verification

- Accept the loan approval after verification is complete

- Select the loan amount and loan tenure

- Enter your bank account details for payment

- Complete the bank (auto-debit) setup

- Receive the loan amount in your bank account

Salaryontime Loan Real Or Fake

As we have learned in this article, Salaryontime Loan is a trustworthy loan platform. It provides personal loans ranging from ₹8,000 to ₹100,000 through Kasar Credit & Capital Pvt. Ltd., an RBI-registered NBFC. The loan tenure is 91 to 365 days. Kasar Credit & Capital Pvt. Ltd. is an RBI-registered non-banking financial company. According to Salaryontime Loan, they use bank-level encryption and strict data security protocols to protect your information.

Note: This article is for informational purposes only. If you choose to take a loan from SalaryOntime, please use your own judgment and borrow responsibly.

FAQs

How much loan can I get from SalaryOnTime?

The loan amount depends on factors such as your income, credit history, and local regulations. SalaryOnTime offers flexible loan amounts tailored to individual needs, with limits in place to ensure responsible borrowing.

Can I repay my SalaryOnTime loan early?

Yes, users can often repay their loans early without any penalty. Early repayment options and any associated fees (if applicable) will be detailed in your loan agreement.

What happens if I can’t repay my SalaryOnTime loan on time?

If you are unable to repay your loan on time, it is essential to contact SalaryOnTime immediately. Depending on the circumstances, SalaryOnTime may offer to extend the repayment period or provide alternative arrangements to help you manage your loan.

Is my personal information safe with SalaryOnTime?

Yes, SalaryOnTime takes the privacy and security of customer information very seriously. According to SalaryOnTime, industry-standard encryption and security protocols are used to protect your personal and financial data.