This article will discuss the Reba Cash Loan App. If you are considering taking a loan from the Reba Cash Loan App, this article can be helpful. In today’s digital age, taking a loan through mobile apps has become quite easy, but some fraudulent mobile loan apps also exist in the market. Therefore, it is your responsibility to analyze any loan application before taking a loan from it. After reading this article, you can decide whether or not you should take a loan.

What is Reba Cash?

The Reba Cash Loan App is a loan platform that claims to provide loans up to ₹20,000 using Aadhaar card and PAN card, with a loan tenure of 12 months. However, both of these claims are completely false.

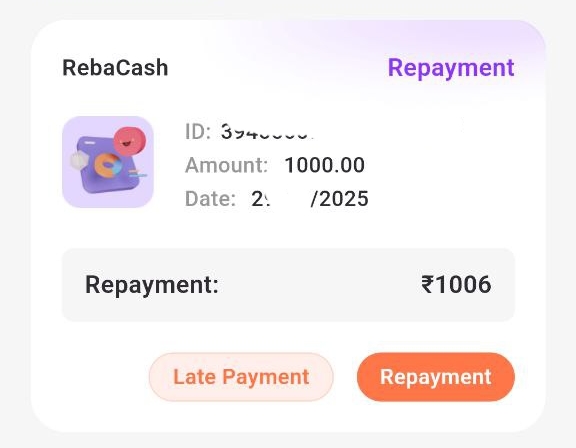

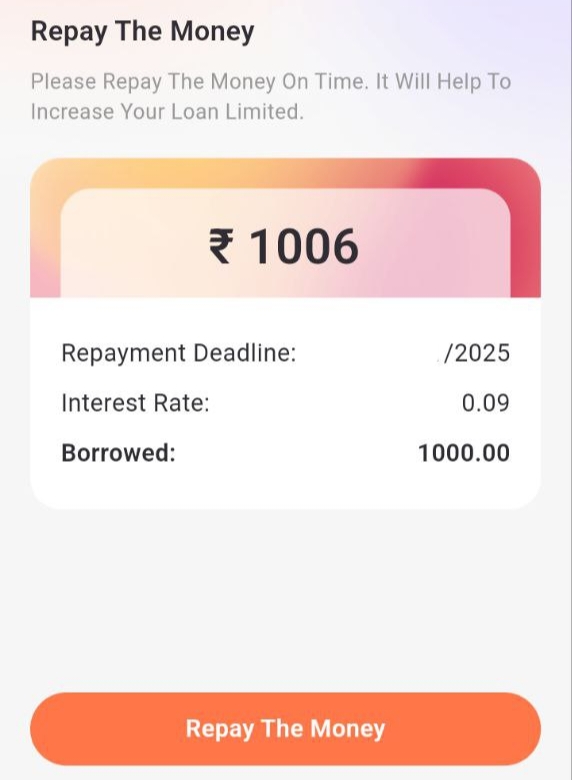

After taking a loan from this application, we observed that this application only provides a loan of ₹1000 for a loan tenure of 7 days, out of which ₹617 will be deposited into your bank account, and you will have to repay ₹1006. This loan application is simply a scam designed to trap people in a web of processing fees and interest.

Reba Cash Loan App Common Complaints

High Interest Rates and Hidden Fees

The most common complaint after taking a loan from the Reba Cash Loan App is that the loan cost is much higher than the amount offered in the loan proposal. After taking the loan, it becomes clear that it only works to trap people in a processing fee scam.

Aggressive Debt Collection

Some users say that if payment is not made within 7 days, the Reba Cash Loan App makes threatening calls, such as hacking numbers from your contact list on your mobile phone and misusing photos from your mobile phone’s gallery and family photos.

For example:

- Loan Amount: ₹1000

- Loan Tenure: 7 days

- Processing Fees: ₹387

- Bank Disbursal Amount: ₹617

- Total Repayment Amount: ₹1006

Boost Loan App With Referral Code

Things to keep in mind when taking a loan

- Choose loan apps that provide transparent information and their contact details for customer support.

- Before accepting any loan offer, carefully review all terms and conditions, interest rates, and fees.

- Beware of loan applications that request excessive permissions, such as access to your contacts or photo gallery, as this information can be misused.

- When applying for a loan, ensure the loan application is registered with the RBI (Reserve Bank of India).

- Always avoid loan applications that demand an advance payment before processing your application.

Reba Cash Loan App: Real or Fake?

As we know, the Reba Cash Loan App is not registered with the Reserve Bank of India. The promises made by this application have been found to be completely false. This application only provides loans of ₹1000 to ₹3000 for a period of 7 days. It is designed solely to trap users in a cycle of interest and processing fees.

Furthermore, this loan application provides loans without checking your CIBIL score, which no RBI-registered loan application does. This is another indicator that it is a fraudulent app.

Note: This article is for informational purposes only. If you are taking a loan, only apply through an RBI-registered loan app. Do not apply for loans through fake applications.

FAQs

How to download the Reba Cash Loan App?

This loan application is not available on the Google Play Store; you can download the Loan APK.

Is Reba Cash Loan App safe?

After taking out the loan, we realized that this loan application was simply a scam designed to trap people into paying processing fees.

What will happen if I don’t repay my Reba cash loan?

Failing to repay a loan can be harmful to you, as it may involve actions such as calling all the contact numbers on your mobile phone, hacking all the photos in your gallery, and potentially compromising your personal data.