In today’s digital age, taking out a loan has become quite easy with the help of mobile apps. However, there are also some fraudulent loan apps available in the market. In this article, we will learn about the Hope Fund Lend loan app. If you are considering taking a loan from the Hope Fund Lend loan app, this article might be helpful for you. It is your responsibility to analyze any loan app before taking a loan from it.

About the Hope Fund Land Loan app

Understanding the Hope Fund Lend Process

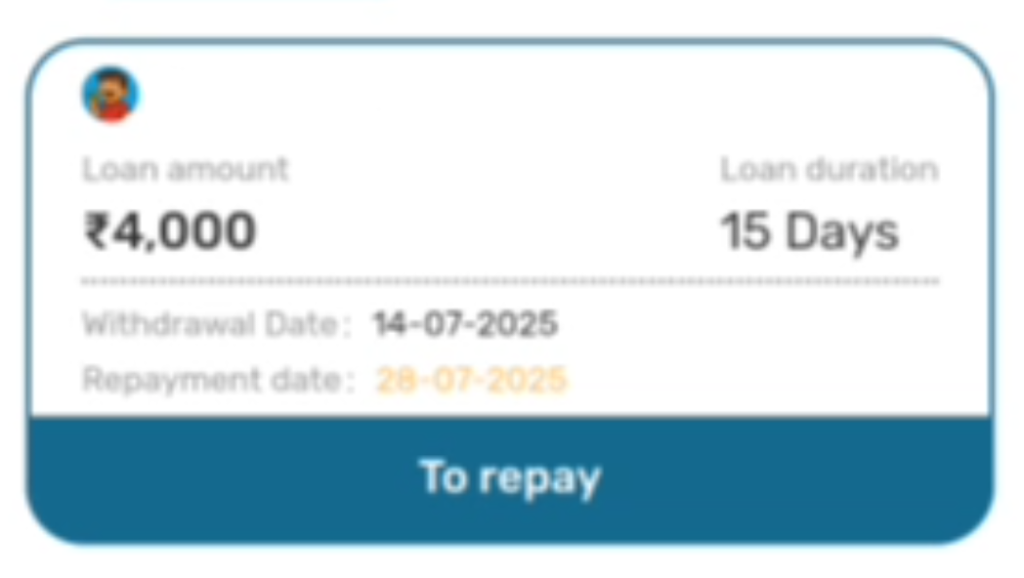

Hope Fund Land is an online digital loan platform that claims to offer loans ranging from ₹5,000 to ₹80,000 with a loan tenure of 365 days, through an NBFC (VAISHALI SECURITIES LIMITED), a non-banking financial institution. However, some users claim, and we also discovered after taking a loan, that this loan application is not registered with the RBI and only provides loans of ₹4,000 for a period of 15 days. This loan application has been removed from the Google Play Store, which raises suspicion.

For example:

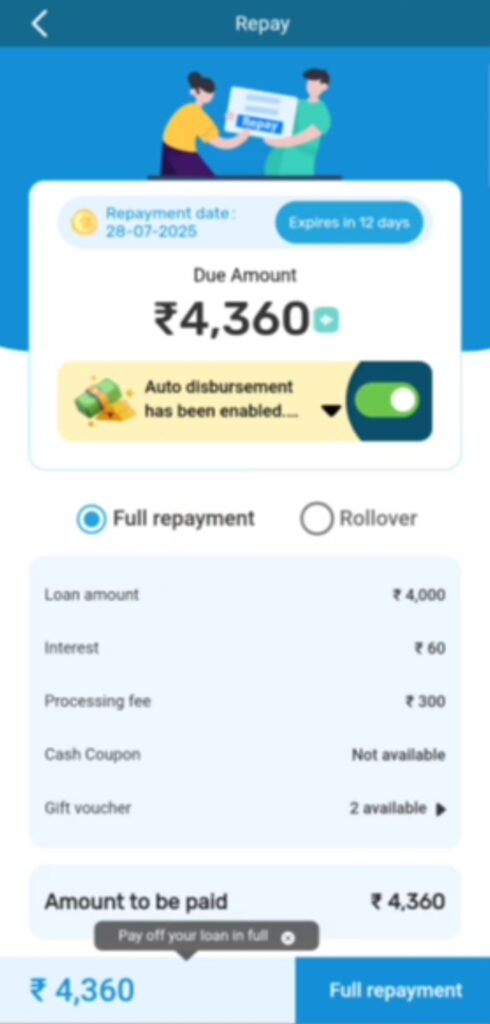

- Loan Amount: ₹4000

- Loan Tenure: 15 days

- Processing Fees: ₹300

- interest amount: ₹60

- Bank Disbursal Amount: ₹2900

- Total Repayment Amount: ₹4360

Signs that the Hope Fund Lend Loan app is fake:

- Friends, the Hope Fund Lend Loan app is currently not available on the Google Play Store, which is also an indication that this loan app is not registered with the RBI.

- Reviews and complaints from some users of the Hope Fund Lend Loan app suggest that it is a company that provides loans for only 15 days, and only a loan of ₹4000, not ₹80000.

- It’s a 15-day loan trap; if the loan is not repaid before 15 days, they resort to harassment and call people on your contact list.

- Although the Hope Fund Lend Loan app claims a loan tenure of 3 to 12 months, complaints from some users and online reviews suggest that it is only a short-term loan app for 15 days.

- They often trap people in a cycle of high interest rates and processing fees in a short period. If this is true, then its description is misleading, which in itself is a big red flag.

- According to RBI rules, no NBFC or loan company can provide a loan without checking the credit score.

- If the Hope Fund Lend Loan app accesses users’ contact lists and photos, it is also a violation of data privacy rules.

Things to keep in mind when taking out a loan

- When taking a loan through any app, pay attention to the permissions requested by the loan app.

- The removal of any loan app from the Google Play Store is a sign that you should not use it on your personal mobile phone.

- Before applying for a loan on any loan application, be sure to check the validity and processing fees.

- Beware of loan apps that request access to your contacts, messages, or other personal data without a clear reason.

- Always apply for a loan only through loan apps registered with the RBI.

- Take a loan only after understanding the loan tenure, loan repayment, and EMI schedule.

- Beware of loan apps that demand fees before the loan amount is disbursed to your bank account.

- Also, be wary of loan apps with hidden charges and unclear contact information.

conclusion

As we learned in this article, the Hope Fund Lend Loan app claims to be registered with the RBI (Reserve Bank of India), but user complaints and reviews indicate that this loan platform is not registered with the RBI. The fact that it has been removed from the Google Play Store also suggests it is not RBI registered. Some users have complained about receiving threatening calls for late payments, and a daily penalty of ₹1000 is added for late payments on loans with a short 15-day repayment period. Although the loan app claims to use a secure HTTPS connection and 128-bit SSL encryption, the lack of transparency and user complaints indicate potential risks.