In this article, we will learn about the Salary Now Quick Advance Loan App. As we know that taking a loan is very important when we need money and we also know how difficult it is to get a loan from a bank, in such a situation, you can use the Salary Now Quick Advance Loan. You can take a personal loan from Salary Now from ₹3000 to ₹100000. It is also important to analyze it before taking a loan. If you are thinking of taking a loan from Salary Now, then this article can be very beneficial for you. Apply for the loan after reading it completely.

What is Salary Now Loan?

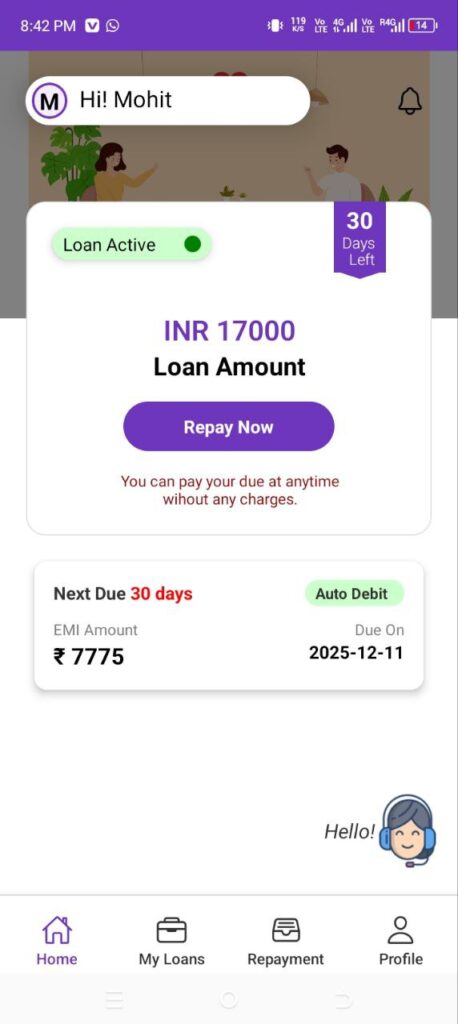

Salary Now is an online loan platform that offers personal loans ranging from ₹3000 to ₹100000 through both RBI registered NBFC partners (ZED LEAFIN Pvt.Ltd./Finkurve Financial Services Limited). This is a salary advance loan. If you need money before your salary is due, you can use Salary Now Quick Advance Loan.

Salary Now Loan Eligibility and Criteria

- The loan applicant must be an Indian citizen.

- Must be a salaried employee.

- The applicant must be over 18 years of age.

- The applicant’s salary must be at least ₹21,000 per month.

- The applicant’s salary must be credited to their bank account.

- The loan applicant must have a good CIBIL score.

Documents for taking a loan

- Aadhaar Card

- PAN Card

- Last three months’ salary slip

- Last one month’s electricity bill or phone bill

- Last three months’ salary bank account statement

Salary Now Loan Benefits and Features

- Salary Now Loan users can avail personal loans ranging from ₹3,000 to ₹1,00,000 for a term of 62 to 365 days to meet all their needs.

- Salary Now Loan is 100% online, allowing you to apply for a loan from the comfort of your home.

- Salary Now Quick Advance Loan platform is specifically designed for those who need money before receiving their salary.

- Salary Now Loan does not require any guarantees or collateral.

- There are no hidden fees when making payments.

- Money can be transferred to your bank account within minutes.

- Salary Now Quick Advance Loan adheres to strict data privacy and other anti-corruption standards to ensure your personal information is protected.

Salary Now Loan Real Or Fake

As we have learned in this article, Salary Now Quick Advance Loan is a loan institution that provides personal loans from ₹3000 to ₹100000 through its NBFC partner (ZED LEAFIN Pvt.Ltd. / Finkurve Financial Services Limited). Both NBFC partners are registered with RBI. Your data is 100% safe here. You can apply for the loan but this is a salary advance loan. If your salary is taking time to get disbursed and you need money, then salary advance loan can be used for salary.

Salary Advance Loan Application Process

To obtain a salary advance loan, follow the steps below.

- First, visit the website https://salarynow.in/ and click here.

- Or you can download the Salary Now Quick Advance Loan from the Google Play Store.

- Verify with your mobile number.

- Fill in all your basic information and upload KYC documents.

- Select the loan amount and loan term you wish to apply for.

- Submit the loan application form and wait for loan approval.

- After submitting the loan application form, you may receive a call for salary advance loan verification.

- After verification is complete, sign the loan agreement upon loan approval.

- The loan amount will then be transferred to your bank account.

Note: This article is for informational purposes only. Loan companies or NBFC banks can update their terms and conditions at any time. For more information, you can visit the official website of Salary Now Loan.

FAQs

1. How much can you avail of a Salary Now Quick Advance Loan?

You can receive a loan offer ranging from ₹3,000 to ₹1,00,000, depending on your profile, credit score, and eligibility.

2. Is Salary Now Loan registered with the RBI?

Salary Now Loan offers loans through its RBI-registered NBFC partner (ZED LEAFIN Pvt. Ltd. / Finkurve Financial Services Limited).

3. How long does it take for a Salary Now Loan to be approved?

The personal loan approval process is quick and simple, taking just minutes.