This article will discuss Salariedloan. If you receive a monthly salary in your bank account and need money, you can consider taking a loan from Salaried Loan. This article can be helpful for you. You can get a loan ranging from ₹5,000 to ₹1,00,000 with a loan tenure of 45 days. However, it is very important to analyze any loan platform before applying. Read this article to understand the Salaried Loan application process before applying.

What is a salaried loan?

Salaried loan is an online loan platform, a brand of RBI-registered NBFC Gopi Securities Pvt Ltd., offering loans ranging from ₹5,000 to ₹100,000. The loan tenure is 45 days. The interest rate is 1% per day. The NBFC partner, Gopi Securities Pvt Ltd., is a Non-Banking Financial Company registered with the Reserve Bank of India and operates in compliance with all applicable regulations.

For example,

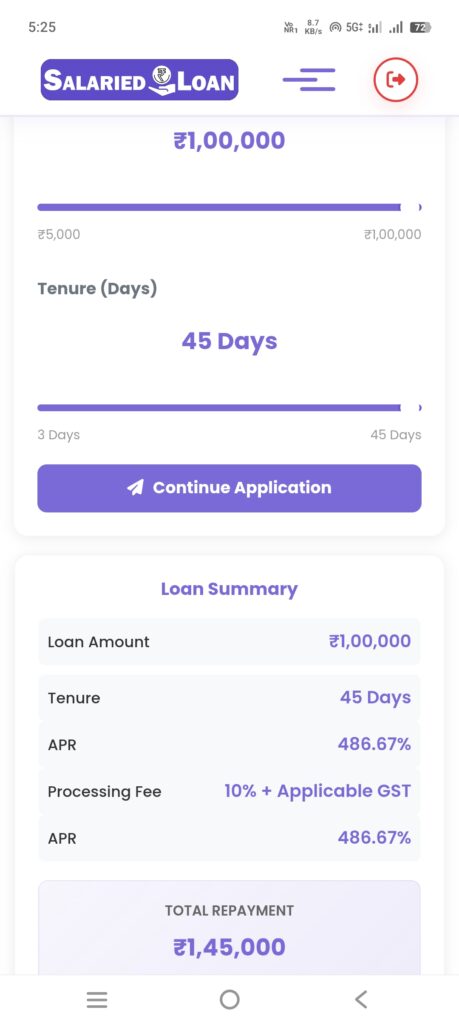

If you take a salaried loan of ₹1 lakh with a loan tenure of 45 days, you can see the details below.

Loan Summary

- Loan Amount: ₹1,00,000

- Tenure: 45 days

- APR: 486.67%

- Processing Fee: 10% + applicable GST

- Total Repayment: ₹1,45,000

Note: This calculation is based on Salariedloan’s information. If you take out a loan, the interest rates and processing fees will vary depending on the loan product and the applicant’s credit profile.

Eligibility and Criteria for Salaried Loans

- The loan applicant must be an Indian citizen.

- Must be a salaried employee.

- Age must be between 21 and 58 years.

- Must be a savings bank account holder.

- Must have a good CIBIL score.

- Monthly income must be credited to the bank account.

- The applicant must have at least 1 year of business or work experience.

Documents Required for Salaried Loans

- Aadhaar Card

- PAN Card

- Proof of Residence – Driving License, Voter ID, Passport, Utility Bill (Electricity/Water/Gas), Postpaid/Landline Bill.

- Bank statements for the last 3 months of the salary account.

- Salary slips for the last 3 months.

- Selfie photo

Salariedloan Service Area

Get timely support in major cities like Delhi NCR, Mumbai, Pune, Bangalore, Hyderabad, and Indore. Whether you’re managing monthly expenses or facing unexpected financial needs, Salariedloan’s easy process helps you bridge financial gaps with confidence.

NCR Region

- 🏛️ Delhi

- 🏢 Gurugram

- 🏗️ Noida

- 🏭 Faridabad

- 🏘️ Greater Noida

- 🏪 Ghaziabad

Central Region

- 🏛️ Bhopal

- 🏔️ Raigarh

- 🏛️ Indore

Salariedloan services are available in all the cities listed above. If you reside in any of these cities, you can apply for a loan.

Salariedloan Loan Benefits and Features

- Users can avail a salary advance loan of ₹5,000 to ₹100,000 for up to 45 days to meet all their needs.

- Salariedloan requires no collateral or guarantor.

- It offers customers a transparent track record with no hidden fees.

- It provides competitive interest rates and transparent APR calculations.

- It adheres to strict data privacy standards to ensure the security of your personal information.

- You can apply for a loan from the comfort of your home using your mobile phone; it’s 100% online.

- Salariedloan is specifically designed for individuals who need money before their salary is credited. They can use it to cover their salary-related expenses.

Salaried Loan Application Process

To apply for a Salaried Loan, please follow all the steps below:

- First, visit the website https://salariedloan.com/

- Register with your mobile number

- Enter your email address

- Provide basic information such as full name, date of birth, and gender

- Fill in your PAN card and Aadhaar card details

- Enter your employment type and company name

- Provide your monthly income details

- Address proof (permanent and current address)

- Selfie

- Bank statement and proof of employment (salary slip / office ID / UAN – for salaried employees)

- Payment bank account details

- eNACH / UPI e-mandate

- Loan amount bank disbursement

Salariedloan: Real or Fake?

As we’ve learned in this article, Salariedloan is a trustworthy loan platform. It offers personal loans ranging from ₹5,000 to ₹100,000 through RBI-registered NBFC Gopi Securities Pvt Ltd. According to Salariedloan, it is committed to maintaining the highest standards to protect your information.

Note: This article is for informational purposes only. If you decide to take out a salaried loan, please use your own judgment and proceed with caution.

FAQs

How to apply for a Salaried Loan

To apply, fill out and submit the loan application on the https://salariedloan.com/ website with the required documents and details.

SalaryLoan Application Review

SalaryLoan reviews your application, which includes conducting a credit check and verifying your documents.

Salaried Loan Bank Disbursement Process

Once your eligibility is approved, the loan amount will be directly transferred to your account.