This article will discuss the LoveFund loan app. If you need a loan in an emergency and are looking for a loan application, the LoveFund loan app could be an option. However, it is your responsibility to analyze the LoveFund loan app before taking out a loan, as there are some fraudulent loan apps in the market these days. Before taking a loan from any loan app, be sure to gather information about it.

About the LoveFund Loan App

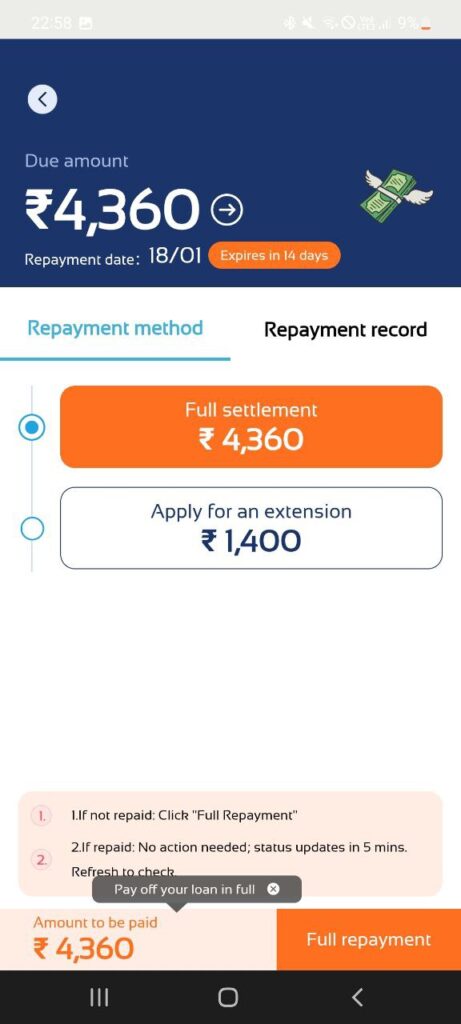

The LoveFund loan app claims to offer loans ranging from ₹7,000 to ₹60,000 with a loan tenure of 92 to 360 days, using only Aadhaar and PAN cards. According to the app’s “About” section, it is a product of Vaishali Securities Limited, an RBI-registered NBFC. However, after taking a loan through the LoveFund app, we observed that initially, only a ₹4,000 loan was disbursed for a 15-day period, with ₹2,840 credited to the bank account. The repayment amount after 15 days would be ₹4,360.

For example:

- Loan amount: ₹4000

- Loan tenure: 15 days

- Processing fee: ₹1160

- Bank disbursement amount: ₹2840

- Total repayment amount: ₹4357

Details provided in the LoveFund loan app

- Loan Amount: ₹7,000 – ₹60,000

- Loan Tenure: 92 days – 365 days

- Daily Interest Rate: 0.05%

- Annual Percentage Rate (APR): 18% – 24%

- Fees: No hidden charges

LoveFund Loan App – Signs of a Scam

Before downloading the LoveFund loan app, it’s crucial to be aware of some important warnings and red flags.

Hidden Fees

The app shows that for a ₹4000 loan, only ₹2840 is disbursed to the bank account, while the repayment amount is ₹4357. This means paying an extra ₹1517 in just 15 days. Be sure to verify this.

High Interest Rates

According to the LoveFund loan app, the interest rate is 0.05% per day. However, charging ₹1517 in interest over 15 days is against RBI regulations.

False Claims

The LoveFund loan app promises loans ranging from ₹7000 to ₹60000 with loan tenures of 92 to 360 days. However, in reality, only ₹4000 loans are being offered with a 15-day tenure, which violates RBI policies.

Aggressive Collection Tactics

Some users have reported aggressive collection strategies, including accessing contact lists, which are characteristic of fraudulent loan apps.

RBI Verification

The LoveFund loan app claims to be partnered with an NBFC partner, Vaishali Securities Limited. Users should verify the registration of this NBFC on the RBI website.

LoveFund Loan App: Real or Fake?

According to the LoveFund loan app, a loan of ₹60,000 is offered with a 12-month repayment period. Both of these claims are completely false. After taking a loan from this application, we found that the loan amount is only ₹4,000 and the repayment period is just 15 days. Only ₹2,840 was actually deposited into the bank account, and you are required to repay ₹4,357 after 15 days. This is the reality of the LoveFund loan, and the promises made in the “About” section of the LoveFund loan app are completely false. Taking a loan from this application can be detrimental to you because spending an extra ₹1,517 for a 15-day loan period proves that it only works to trap people in a cycle of processing fees and interest.

FAQ

How to download the LoveFund loan app?

This loan application is available on the Google Play Store. You can download the LoveFund loan app from there.

is the LoveFund app registered with the RBI?

According to the LoveFund loan app, it claims to be registered with the RBI and presents Vaishali Securities Limited as its NBFC partner. However, after taking a loan, we observed that this loan app provides loans without checking the CIBIL score, which is something no RBI-registered loan app does.

Is this loan app safe?

After taking a loan from the LoveFund loan app, we observed that this loan app only serves to trap users in a web of processing fees and charges.

What happens if I don’t repay the LoveFund loan?

Not repaying the LoveFund loan amount can be detrimental to you because it can compromise all the contact numbers on your mobile phone and all the photos available in your mobile phone’s gallery.