Cashvia Loan: As we know, when people need money urgently, they often think of taking out a loan. If you need money immediately and are looking for a quick loan, Cashvia Loan could be a great option for you. With Cashvia Loan, you can get a personal loan ranging from ₹5000 to ₹100000, with a loan tenure of 365 days. However, it’s important to understand the details of Cashvia Personal Loan before applying. It is your responsibility to analyze any loan application before applying. Please read this entire article before applying for a Cashvia Personal Loan.

What is Cashvia?

Grow Money Capital Private Limited is a non-banking institution registered with the Reserve Bank of India, operating as an NBFC Partner and adhering to all applicable RBI rules and regulations.

Cashvia Loan is an online loan platform that provides personal loans ranging from ₹5,000 to ₹500,000 through its NBFC partner (Grow Money Capital Private Limited). The loan tenure is 12 months, with an interest rate of 1% per month and processing fees of up to 3%.

Cashvia Loan Benefits and Features

- Users can avail of personal loans ranging from ₹5000 to ₹5 lakh for 365 days to meet all their needs.

- To get an instant loan, you can apply for a loan from the comfort of your home using your mobile phone. You will receive the loan in a short time.

- With Cashvia Loan, you don’t need any guarantee or collateral.

- Cashvia Loan provides a transparent track record for customers without any hidden fees.

- It offers competitive interest rates and transparent APR calculations.

- It adheres to strict data privacy and encryption standards to ensure your personal information remains secure.

- Cashvia Loan is specially designed for people who need money before their salary arrives. You can use Cashvia Personal Loan for your salary needs.

Cashvia Personal Loan Eligibility and Criteria

- The loan applicant must be an Indian citizen.

- The applicant must be a salaried employee.

- The applicant’s salary should be at least ₹21,000 per month.

- The applicant must be over 21 years of age.

- The loan applicant’s salary must be credited to their bank account.

- The applicant must have a good CIBIL score.

Cashvia Loan Required Documents

- Aadhaar card must be linked to your mobile number

- PAN card is required

- Income proof is required (salary slip or bank statement)

- Bank statement of your salary account is required

- Selfie photo is required

Cashvia Loan: Real or Fake?

As we have learned in this article, Cashvia Loan is a lending institution that provides loans ranging from ₹5,000 to ₹5 lakh through its NBFC partner (Grow Money Capital Private Limited). According to the Cashvia loan platform, it is committed to maintaining the highest standards of information security, data privacy, and security. We comply with all applicable laws and regulations and adhere to all Reserve Bank of India guidelines for loans and data security.

Cashvia Loan Application Process

To apply for a Cashvia Loan, follow all the steps given below:

- First, go to the website https://cashvia.in/ and click on it.

- Register using your mobile number.

- Fill in your basic information and upload your KYC documents.

- Select the loan amount and loan tenure.

- Submit the loan application form and wait.

- After submitting the loan application form, you may receive a verification call from Cashvia Loan company.

- After verification is complete, a loan offer will be provided to you.

- After loan approval, sign the loan agreement!

- The loan amount will then be transferred to your bank account.

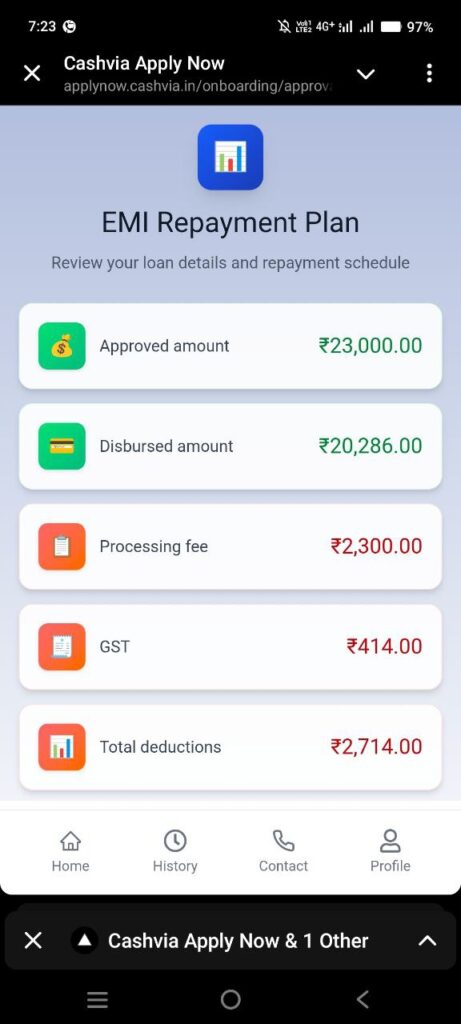

For example

- Loan Amount: ₹23,000

- Loan Tenure: 3 months

- Bank Disbursal Amount: ₹20,285

- Processing Fees: ₹2300

- GST: ₹414

Note: This article is for informational purposes only. Please use your own judgment when applying for a loan.

FAQs

1. How to get a Cashvia Loan?

To apply for a Cashvia loan, visit their official website mein.in and submit your application.

2. What will be the interest rates on Cashvia Loan?

According to Cashvia Loan, initial interest rates can be as low as 1% per month.