Cashtoyou Loan: As we know, taking out a loan has become quite easy in today’s digital age, and we also know how difficult it can be to get a loan from a bank. In this situation, you can apply for a loan comfortably from the convenience of your home using your mobile phone on the Cashtoyou Loan website. However, before applying, it is your responsibility to analyze the Cashtoyou Loan company. According to the Cashtoyou Loan platform, you can get a loan of ₹40,000 if you have a PAN card, Aadhaar card, and a bank account. But before applying, please read this article carefully.

What is Cashtoyou?

Cashtoyou Loan is a multinational financial company now available in India. It’s a platform that facilitates loan transactions between applicants and NBFCs. Cashtoyou Loan company provides personal loans of up to ₹40,000 across India through its NBFC partners (Mount Shikhar Financial Services Ltd. / Savantika Vanijya Pvt. Ltd.).

Cashtoyou Loan Benefits and Features

- Applicants can get an instant loan of ₹40,000 to meet all their needs.

- The funds are disbursed instantly to the bank account provided in the loan application. The posting time depends on your bank account and in some cases, it may take more than one business day.

- It adheres to strict data privacy and encryption standards to keep your personal information secure.

- It offers competitive interest rates and transparent APR.

- This platform provides loans to its customers without any hidden fees.

- You will not need any collateral to get a Cashtoyou Loan.

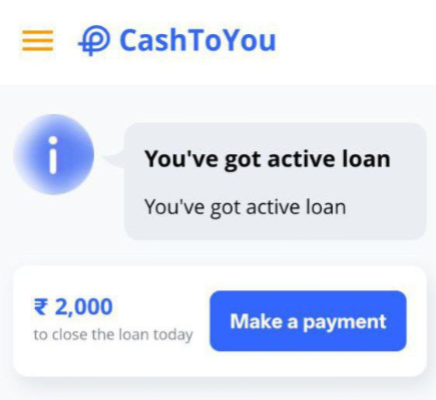

- After you repay your loan, it offers good loan offers to its customers.

- You will be given the option of a repeat loan to reapply for a loan. You can get a repeat loan in just a few steps.

Cashtoyou Loan Eligibility and Criteria

- The loan applicant must be an Indian citizen.

- They must be a salaried or self-employed individual.

- The applicant must be 22 years of age or older.

- The loan applicant must have a stable income.

- They must have an active personal bank account.

- Aadhar card and PAN card must be available.

Cashtoyou Loan: Real or Fake?

As we learned in this article, this is a multinational loan platform that offers personal loans of up to ₹40,000 through RBI-registered Non-Banking Financial Institutions (Mount Shikhar Financial Services Limited / Sawantika Vanijya Private Limited). According to the Cashtoyou loan platform, it complies with all Reserve Bank of India regulations and employs strict data privacy measures to protect your information.

Cashtoyou Loan application process

To apply for a Cashtoyou Loan, follow all the steps given below:

- First, go to the website https://cashtoyou.in/ and click on it.

- Register using your mobile number.

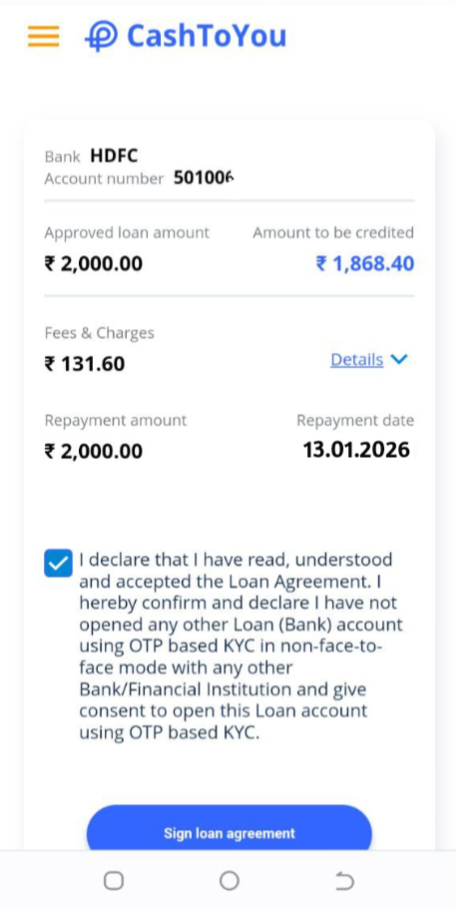

- Fill in your basic information and upload your KYC documents.

- Choose the loan amount and loan tenure.

- After submitting the loan application form, wait for the loan offer.

- Once you receive the loan offer, complete the auto-debit setup.

- Fill in your bank account details.

- Receive the loan amount in your bank account.

Note: This article is for informational purposes only. Use your own judgment when taking out a loan.

FAQs

Documents required for a Cashtoyou Loan

You must have an Aadhaar card and PAN card to apply for the loan.

How long does it take to receive the Cashtoyou Loan amount?

You will receive the funds in the bank account provided in your application. The actual posting time depends on your bank and in some cases, it may take more than one business day.

What are the loan amount and loan tenure for a Cashtoyou Loan?

For first-time applicants, the current loan amount ranges from ₹1000 to ₹10000. Repeat borrowers with a good credit history can get a loan of up to ₹40000. The loan tenure will be 7 to 28 days.

What are the interest rates for a Cashtoyou Loan?

Interest rates depend on the product, with a maximum of 0.2% and a minimum of 0% per day! Overdue interest will be charged at a rate of 0.2% per day.