Amount Pro: This article will tell you about the Amount Pro loan app. If you need money and are considering taking a loan from the Amount Pro loan app, this article can be helpful. These days, there are some fake loan apps in the market, so it’s important to analyze any loan app before taking a loan from it. In this article, you can find out whether you should take a loan from the Amount Pro loan app or not, and whether the Amount Pro loan app is genuine or fake.

What is Amount Pro Loan App?

Amount Pro is a digital personal loan app that provides loans for 15 days. It offers a convenient way to get a loan in emergencies. Amount Pro Loan App is a non-NBFC (Non-Banking Financial Company) and is not registered with the RBI (Reserve Bank of India). This app allows you to get an instant loan in emergencies. For first-time applicants, you can get a loan of up to ₹5000 for 15 days using only your Aadhaar card and PAN card.

Note – This app is not registered with the RBI (Reserve Bank of India), and your data is not secure on this application.

Benefits of taking an Amount Pro Loan

- This app allows you to get a loan instantly in case of an emergency.

- Amount Pro Loan App can provide loans even with a low CIBIL score.

- No income proof is required to get a loan.

- No collateral or guarantee is needed to get a loan through this app.

- In case of an emergency, the money is credited to your bank account within 10 to 15 minutes.

- You can get a loan of ₹5000 for 15 days using only your Aadhaar card.

Disadvantages of taking an Amount Pro Loan

- This app is not registered with the RBI (Reserve Bank of India).

- Your data is not safe on this loan app.

- If you take a loan from Amount Pro Loan App and fail to repay on time, the app may call your contact list, and you may be scammed.

- Loans from this app are only offered for a period of 15 days.

- Loans from this app have high charges, and the processing fees and interest rates are excessive.

- If you fail to make timely payments, Amount Pro Loan App may harass you.

For example

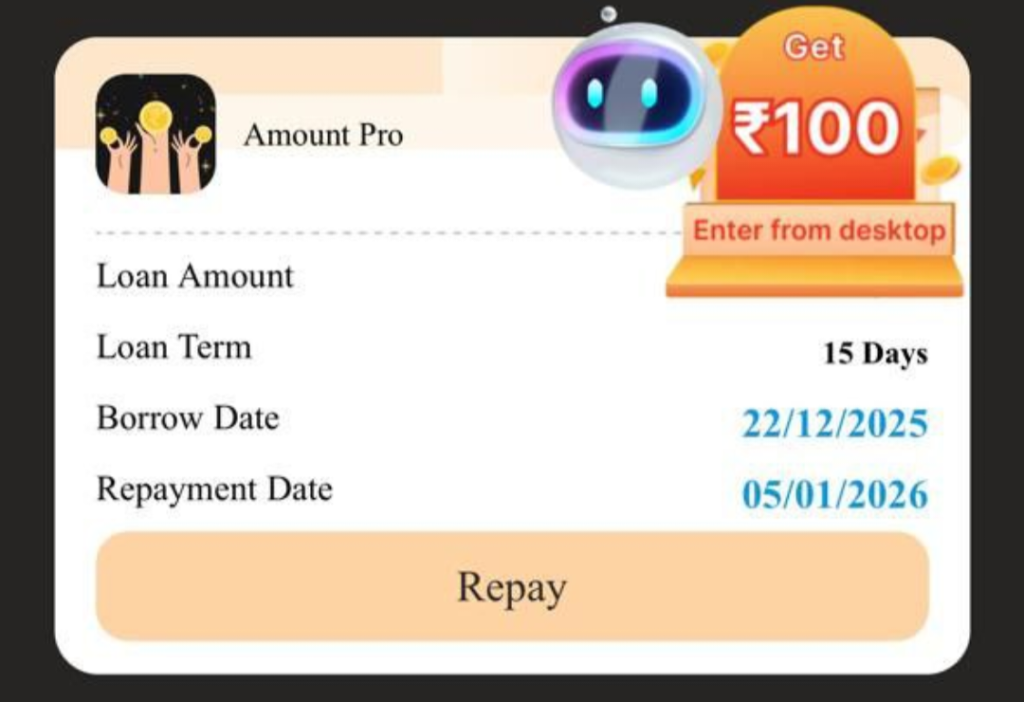

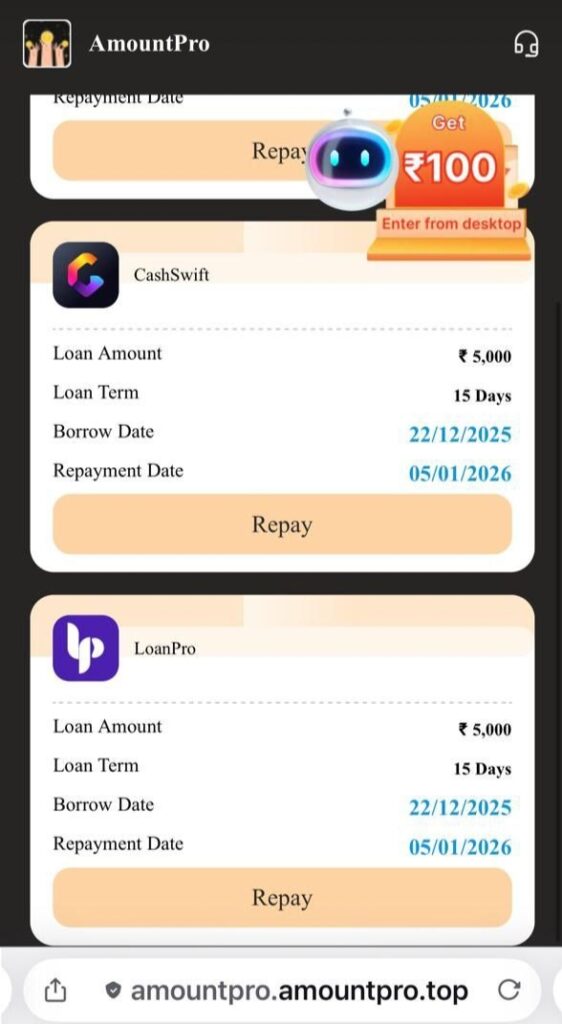

If you take a ₹5000 loan for 15 days from Amount Pro Loan App:

- Loan Amount: ₹5000

- Loan Tenure: 15 days

- Processing Fee: ₹1300

- Amount Disbursed to Bank: ₹3700

- Interest Amount: ₹250

- Total Repayment Amount: ₹5250

Amount Pro Loan App: Real or Fake?

Friends, if we talk about the Amount Pro Loan App, this app is not registered with the Indian government. However, this app can provide you with a small loan in 10 to 15 minutes during an emergency. If you need a loan urgently, you can apply for a loan through this application. Otherwise, please note that this application is not registered with the RBI (Reserve Bank of India), and your data may not be secure if you apply through this application.

Amount Pro Loan allows you to get a loan of ₹5000 within 10 to 15 minutes using just your Aadhaar card, PAN card, and a selfie. The loan tenure is 15 days. You don’t need any income proof to get a loan through this app. Even if you have a low CIBIL score, you can still get an emergency loan from Amount Pro Loan.

Note: This article is for informational purposes only. Always take loans from RBI-registered loan apps. Do not apply for loans from any fraudulent loan apps.

FAQs

How to download the Amount Pro app?

This loan application is not available on the Google Play Store; you can download the AmountPro APK.

Is the Amount Pro Loan App safe?

After taking a loan through Amount Pro, we realized that this loan application is simply a scam designed to trap people into paying processing fees and is not registered with the RBI.

What will happen if I don’t pay the amount for the Pro Loan?

Failure to repay the loan amount can be harmful to you, as it may involve actions such as calling all the contact numbers on your mobile phone, hacking all the photos in your gallery, and compromising your personal data.