As we know, when a financial emergency arises, some people consider taking out a loan. If you need money urgently, a Cash247 Instant Personal Loan can be a great option. With Cash247, you can get a personal loan ranging from ₹5,000 to ₹200,000, with a loan tenure of up to 365 days. However, it is your responsibility to analyze the loan details before applying. In this article, you can easily find all the details about the Cash247 Instant Personal Loan. Be sure to read this article.

What is cash247?

cash247 is an online loan platform that provides personal loans of up to ₹200,000 through its NBFC partner, SIDDHI TRADERS PRIVATE LIMITED. The loan tenure is 365 days, and the interest rate is 1% per day.

SIDDHI TRADERS PRIVATE LIMITED is a non-banking financial company (NBFC) registered with the Reserve Bank of India. It operates as an NBFC partner and adheres to all applicable rules and regulations.

For example,

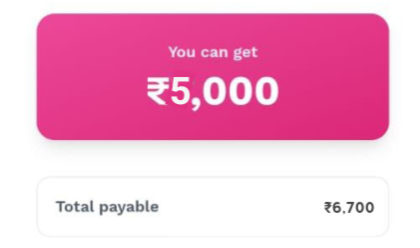

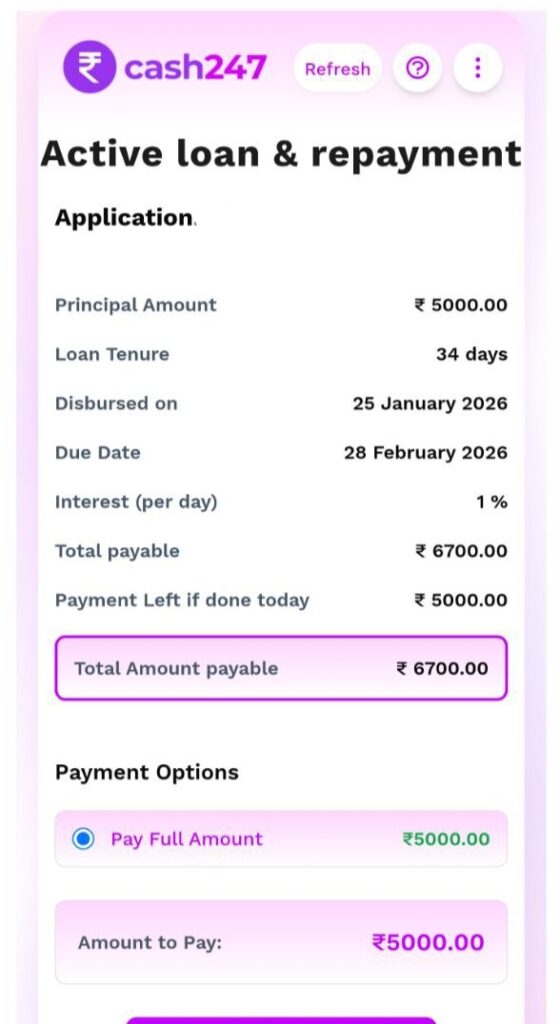

We took out a loan of ₹5000 from Cash247 Instant Personal Loan, of which ₹4410 was credited to our bank account. The loan tenure is 34 days, and we have to repay ₹6700 after 34 days.

- Loan amount: ₹5000

- Loan term: 34 days

- Bank disbursement amount: ₹4410

- Interest rate: 1% par day

- Total repayment: ₹6700

cash247 Instant Personal Loan Eligibility and Criteria

- The loan applicant must be an Indian citizen.

- The applicant must be 21 years of age.

- Monthly income should be ₹18,000 (Metro) and ₹15,000 (Non-metro).

- Must have 1 year of business or work experience.

cash247 Loan Required Documents

- Aadhaar Card – must be linked to a mobile number

- PAN Card

- Proof of income (salary slip or bank statement)

- Bank statement of the salary account

- Selfie photo

cash247 Loan: Benefits and Features

- Users can avail of personal loans ranging from ₹5000 to ₹200000 for 365 days to meet all their needs.

- With Cash247 Instant Personal Loan, you don’t need any guarantee or collateral.

- Cash247 provides a transparent track record for its customers with no hidden fees.

- It offers competitive interest rates and transparent APR calculations.

- To ensure the security of your personal information, Cash247 Loan adheres to strict data privacy standards.

- You can apply for an instant loan from the comfort of your home using your mobile phone; it’s 100% online.

- Cash247 Instant Personal Loans are especially designed for people who need money before their salary arrives. You can use Cash247 Loan to bridge the gap until your next paycheck.

cash247 Instant Personal Loan Application Process

Follow all the steps below to apply for a cash247 loan:

- First, visit the website https://www.cash247.in/

- Mobile Number

- Full Name, Date of Birth, and Gender

- PAN Card and Aadhaar Card

- Type of Employment and Company Name

- Monthly Income

- Proof of Address (Permanent and Current Address)

- Selfie

- Bank Statement and Proof of Employment (Salary Slip / Office ID / UAN – for salaried employees)

- Payment Bank Account Details

- eNACH / UPI E-Mandate

- Loan Amount Bank Disbursement

Cash247 Instant Personal Loan: Real or Fake?

As we learned in this article, Cash247 Loan is a trustworthy loan platform. It offers personal loans ranging from ₹5,000 to ₹200,000 through SIDDHI TRADERS PRIVATE LIMITED, an NBFC registered with the RBI. According to Cash247 Loan, it is committed to maintaining the highest standards to protect your information.

Note:- This article is for informational purposes only. If you decide to take a loan from Cash247, please use your own judgment and proceed with caution.

FAQs

What is a Cash247 loan and how does it work?

cash247 is a digital lending platform that provides short-term personal loans instantly. Users can apply online, complete the verification process digitally, and receive the funds directly into their bank account within minutes of approval.

Who is eligible to apply for a loan from Cash247?

Any Indian citizen who meets the basic eligibility criteria—such as age, income, and a valid identity document—can apply.

What is a Non-Banking Financial Company (NBFC)?

Non-Banking Financial Company (NBFC) SIDDHI TRADERS PRIVATE LIMITED is a financial institution registered with the Reserve Bank of India (RBI) that provides services such as loans and credit, but does not accept demand deposits like traditional banks.