Salary TopUp Loan: In today’s era of rising inflation, anyone can need money. We understand how you feel when you need money urgently but can’t ask a friend or relative, and we also know how difficult it is to get a loan from a bank because the process is very lengthy. In such times of need, a Salary Top-Up Loan can be an excellent option for you. The Salary Top-Up Loan is specifically designed for people who unexpectedly need money before their salary arrives. If your salary is still some time away, a Salary TopUp Loan provides a personal loan against your salary. If you are also thinking of taking a loan through a Salary Top-Up, then this article will be helpful for you.

What is a salary top-up loan?

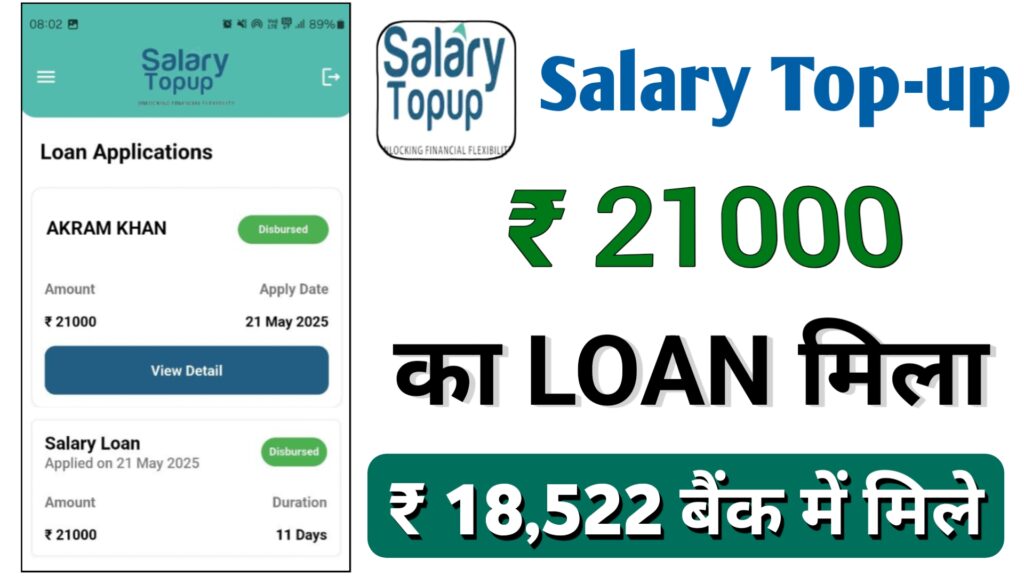

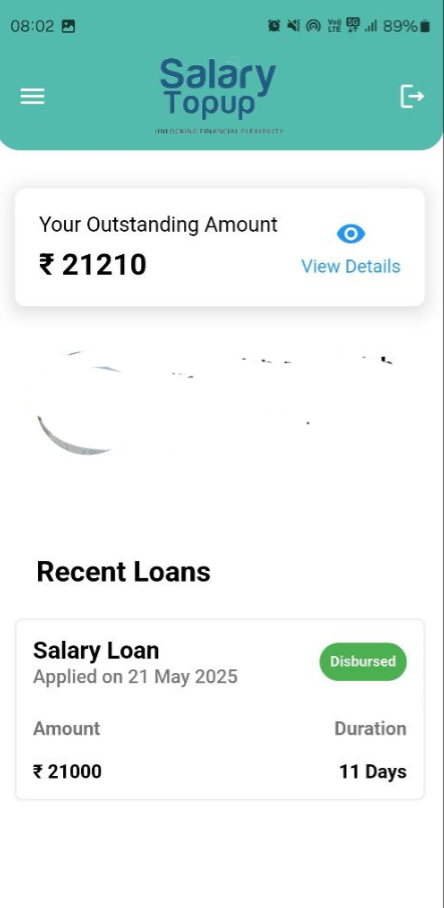

Salary TopUp Loan, presented by (Baid Stock Broking Services Private Limited,) is a mobile app that provides personal loans to its customers. The Salary TopUp Loan app is registered with the RBI (Reserve Bank of India) and is a secure lending platform. It offers loans ranging from ₹5,000 to ₹100,000 to its customers, with a loan tenure of 365 days.

Salary TopUp Loan Features and Benefits

- Users can avail a loan of up to ₹100,000 for 365 days to meet their needs.

- Salary TopUp Loan offers competitive interest rates and transparent APR calculations.

- Salary TopUp Loan is beneficial for new employees and those with a low CIBIL score.

- The loan amount is credited to the bank account within minutes through the mobile app.

- Salary TopUp Loan is especially designed for salaried individuals who need money before their salary is credited; they can get an advance salary loan here.

Disadvantages of taking a Salary Top-Up Loan

- Taking out loans can cause a person to feel a shortage of money at the beginning of every month.

- Taking out loans repeatedly before payday, or frequently taking out advance loans, can become a habit.

- If the money is spent before the salary arrives, it becomes very difficult to save at the end of the month.

- Salary Top-Up Loans have significant processing fees and transaction charges; taking out loans repeatedly can become a heavy burden over time.

- It will be very difficult for you to make any major expenses or investments.

- Taking out advance loans repeatedly also disrupts your long-term financial plans.

Salary TopUp Loan Eligibility and Criteria

- The loan applicant must be an Indian citizen.

- They must be a salaried employee.

- The loan applicant’s salary must be at least ₹20,000 per month.

- The loan applicant must be over 21 years of age.

- The salary must be received in a bank account.

- The CIBIL score should be good.

Things to keep in mind when taking out a salary top-up loan.

- Use the salary top-up loan app only for emergencies.

- Plan your expenses before taking a loan, and only then apply for one.

- Taking an advance salary loan without a genuine need can become a burden for you.

- Before taking a loan from any loan company, it is essential to know their hidden fees and contact information.

- Always avoid companies that request any kind of fee before disbursing the loan amount into your bank account.

- Always apply for a loan only when needed; do not apply for a loan from any loan company unnecessarily.

- If you have taken a loan for a genuine need, repay it on time.

- You should avoid taking a loan from any company that hides its contact information and fee details.

Salary TopUp Loan Application Process

You can apply for a Salary TopUp Loan in just a few steps. Follow the steps below:

- Download the Salary TopUp Loan mobile app from the Google Play Store.

- Sign up with your mobile number and complete your profile.

- Upload all the required documents. Submit the application form.

- Receive loan approval and the loan offer.

- The loan amount will be credited to your bank account shortly.

Salary TopUp Loan App: Real or Fake?

As we’ve learned in this post, a Salary TopUp Loan is a salary loan and is registered with the RBI (Baid Stock Broking Services Private Limited) as an NBFC. You can take this loan as an advance salary loan against your salary. This loan company provides loans ranging from ₹5000 to ₹100,000 for a period of 365 days. You can receive the salary through the Salary Top Up Loan app, but it will only be disbursed after you submit your salary slip. You cannot get this loan without a salary or income proof. Only salaried employees should apply for this loan; it is not available for business purposes.

Note: This article is for informational purposes only. Please use your own judgment when taking out a loan.