If you need a personal loan and are looking for a loan app, this article might be helpful. In this article, we will learn about Micromoney Loan. You can get a personal loan of ₹5,000 to ₹200,000 through Micromoney Loan, with a loan tenure ranging from 3 months to 365 days. However, before taking a loan from any loan app, it’s essential to analyze it thoroughly. In this article, you can find out how much interest will be charged on the loan, what documents are required, and what other charges will apply.

What is Micromoney?

Micromoney is an online digital lending platform registered with the Reserve Bank of India through its NBFC (Yashik Finlease Private Limited). It provides personal loans ranging from ₹5,000 to ₹200,000 with a loan tenure of 62 to 365 days. You can apply for a loan 24/7 anytime using your mobile phone.

Micromoney loan features

- 100% online process: Apply online from the comfort of your home.

- Simplified process Only basic documents are required, no paperwork.

- No hidden fees.

- No collateral required for the loan.

- Choose repayment terms that suit your needs.

- Apply for a micro money loan anytime, anywhere with our 24/7 mobile app.

- Upon loan approval, the loan amount is instantly transferred to your bank account.

Micromoney Loan Eligibility and Criteria

- The loan applicant must be an Indian citizen.

- The applicant’s age should be between 21 and 60 years.

- The applicant’s monthly salary should be ₹15,000.

- To apply for the loan, you need a smartphone, a bank account, a PAN number, and an Aadhaar number.

Interest rates and other charges

- Interest Rate: 0% to 36%

- Payment Charges: Up to 8.33% per month on the payment amount, minimum ₹500 + GST

- Mandate Rejection Charges: ₹250 + GST

- Bounce Charges: ₹500 + GST

- Prepayment Charges: No charges

- Processing Fees (including GST): ₹500 to ₹11,918 (depends on the loan amount and loan tenure)

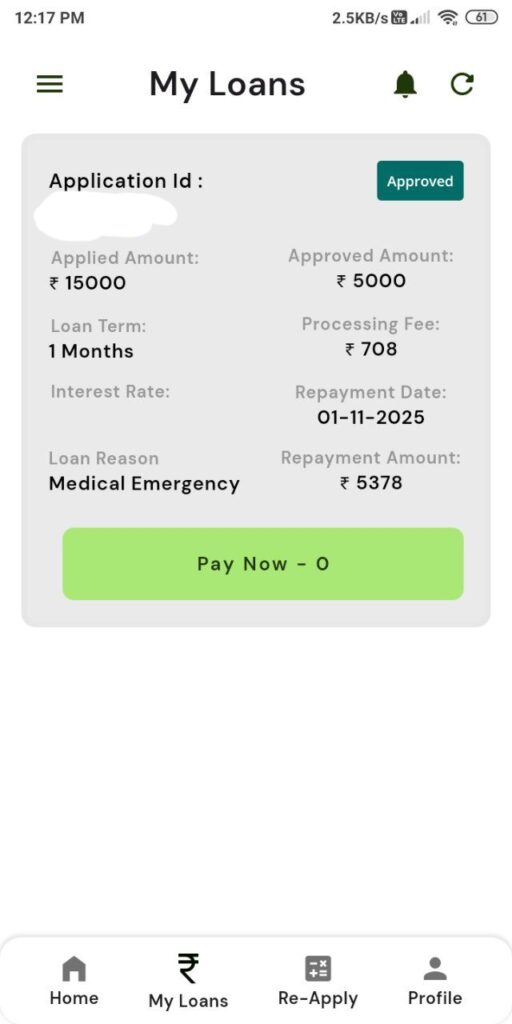

For example

If you take a Micromoney loan of ₹15,000 for 3 months, you can see the complete calculation below:

Loan Amount: ₹15,000

Loan Tenure: 3 months

Interest Rate: 36% per annum

Processing Fees + GST: ₹826

Bank Disbursal Amount: ₹15,000 – ₹826 = ₹14,174

Flat Interest: ₹15,000 * 3/12 * 36% = ₹1,350

Total Repayment Amount: ₹15,000 + ₹1,350 = ₹16,350

Monthly EMI: ₹16,350 / 3 = ₹5,450

Note: Actual interest rates and fees may depend on your loan eligibility and verification. This may vary depending on your profile

About MicroMoney Loans

The Micro Money Loan app is registered with the RBI and provides personal loans ranging from ₹5,000 to ₹200,000 through an NBFC (Yashik Finlease Private Limited). The loan tenure is from 62 days to 365 days, with an annual interest rate of 0% to 36%. When you take a loan through the Micromoney Loan App, your data is completely 100% secure. You can apply for a loan online from the comfort of your home, 24/7, anytime, anywhere.

Micromoney Loan application process

- Download the Micromoney Loan App

- Complete mobile number and email verification

- Create an account and complete your profile

- Fill out the application form and submit your documents

- Wait for loan application evaluation and loan approval

- After loan approval, choose the loan term and loan amount

- The approved loan amount will be transferred to your bank account

Note: This article is for informational purposes only. Please use your own judgment when applying for a loan.

Micro Money Loan Customer Support

Email: support@micromoney.in

Mobile: +91 9773899027

Address: 4th Floor, 410, NK Centre, Vanijya Nikunj Wing A, Plot No. A, Udyog Vihar, Phase-V, Gurugram, Haryana – 122016

FAQs

Is the Micro Money loan app approved by the RBI?

The Micro Money loan app operates in partnership with RBI-registered NBFC, Yashik Finlease Private Limited, ensuring compliance with regulatory norms.

Is the Micro Money loan app safe?

The Micro Money loan app appears to be a trustworthy platform that operates legally and emphasizes data security and transparency. However, as with any online lending service, it is advisable to exercise caution and borrow responsibly when using it.

Who is eligible to get a loan through the Micro Money app?

To get a loan through the Micro Money app, you must be an Indian citizen and earn ₹15,000 per month.

What are the interest rates of the Micromoney Loan App?

Interest rates vary depending on the loan amount and the applicant’s profile.