As we know, when a financial emergency arises, some people consider taking out a loan. If you need money, the Kubiz Loan App can be a great option. With the Kubiz Loan App, you can get a personal loan ranging from ₹5,000 to ₹100,000, with a loan term of 3 to 4 months. However, it’s your responsibility to analyze the loan details before applying. In this article, you can easily find all the details about the Kubiz Capital loan app. Be sure to read this article.

What is Kubiz

Kubiz is an online loan app operated by Kubiz Capital Private Limited, an RBI-registered non-banking finance company. It offers personal loans ranging from ₹5,000 to ₹100,000 through the Kubiz loan app. Loan tenures range from 3 to 4 months, and interest rates range from 1.5% to 3% per month.

Kubiz Capital Private Limited is a non-banking financial company (NBFC) registered with the Reserve Bank of India. It operates as an NBFC partner and complies with all applicable rules and regulations.

For example

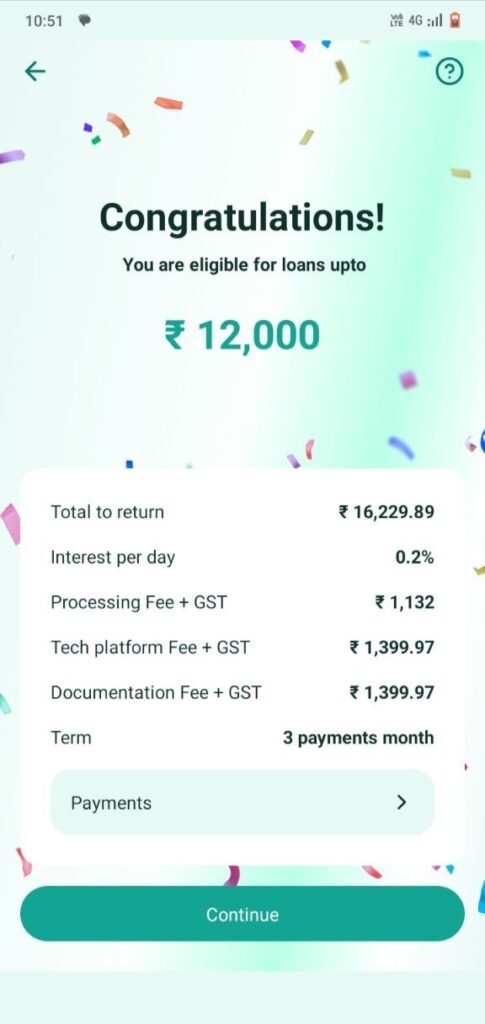

We took a loan of ₹12,000 from the Kubiz Loan App, of which ₹10,868 was credited to our bank account. The loan tenure is 90 days, and we have to repay ₹16,229.89 in three installments within 90 days.

- Loan Amount: ₹12,000

- Loan Tenure: 90 Days

- Bank Disbursement Amount: ₹10,868

- Interest Rate: 0.2% per day

- Processing Fee + GST: ₹1,132

- Platform Fee + GST: ₹1,399.97

- Documentation Fee + GST: ₹1,399.97

- Total Repayment: ₹16,229.89

Kubiz Loan App Eligibility and Criteria

- Loan applicants must be Indian citizens.

- Must have a valid PAN card and Aadhaar card.

- Applicants must be at least 18 years old.

- Monthly income must be ₹15,000.

- Must have 1 year of business or work experience.

Kubiz Loan App Required Documents

- Address proof (Aadhaar)

- Selfie

- PAN card

- Valid bank account

Kubiz Loan: Benefits and Features

- Users can avail personal loans ranging from ₹5,000 to ₹100,000 for 90 to 120 days to meet all their needs.

- With the Kubiz Loan App, you don’t need any guarantees or collateral.

- The Kubiz Loan App offers its customers a transparent track record with no hidden fees.

- It offers competitive interest rates and transparent APR calculations.

- To ensure the security of your personal information, the Kubiz Loan App adheres to strict data privacy standards.

- You can apply for an instant loan from the comfort of your home using your mobile phone; it’s 100% online.

- The Kubiz Loan App is specifically designed for those who need money before their salary arrives. You can use the Kubiz Loan App to bridge the gap until your next salary.

Kubiz Loan App: Real or Fake

As we learned in this article, Kubiz is a trusted loan platform. It offers personal loans ranging from ₹5,000 to ₹100,000 through Kubiz Capital Private Limited, an RBI-registered NBFC. According to the Kubiz Loan App, it is committed to maintaining the highest standards for the security of your information, as Kubiz is an RBI-registered NBFC (CIN U65999MH2010PTC204859).

Kubiz Loan Application Process

Follow the steps below to apply for a Kubiz Loan:

- First, download the Kubiz Loan App or visit the website https://kubiz.in/

- Register with your mobile number

- Enter basic details including full name, date of birth, and gender

- Enter PAN and Aadhaar card details

- Employment type and company name

- Monthly income

- Address proof (permanent and current address)

- Selfie

- Payment bank account details

- eNACH/UPI e-mandate

- Loan amount bank disbursement

Note: This article is for informational purposes only. If you decide to take out a loan from the Kubiz Loan App, please use your common sense and proceed with caution.

FAQs

How much loan amount can I get from the Kubiz Loan App?

You can check loan offers based on your income and repayment history, but the maximum personal loan amount is ₹1 lakh.

How long does it take for a Kubiz loan to be approved?

Most users experience loan approval within minutes, and the amount is credited directly to your bank account immediately after approval.

How to repay your Kubiz loan

You can choose flexible EMIs of up to 3 months and repay via auto-debit or UPI.

Can I apply for a Kubiz loan if I already have another loan

Yes, you can—as long as your income and repayment capacity meet the eligibility criteria, you can apply for a Kubiz loan.

Can I pre-close my loan?

Yes! You can repay your loan early at any time—no hidden prepayment penalties.