In this article, we will learn about Bitsyyloan. If you need money urgently and are looking for a loan in an emergency, BITSYYLOAN provides instant loans to salaried professionals. It is powered by a unique predictive algorithm, SBQ (Social Borrowing Quotient), which creates a credit profile of the loan applicant that is not based on traditional banks and NBFC loan agencies. You can now get a personal loan ranging from ₹5,000 to ₹5,00,000. If you are also considering applying for a loan on Bitsyyloan, let’s analyze it completely in this article.

What is Bitsyyloan?

Bitsyyloan is an online digital personal loan platform that specifically provides loans ranging from ₹5,000 to ₹500,000 to salaried individuals! It operates as a fintech company rather than a traditional NBFC (Non-Banking Financial Company) and is registered with the Reserve Bank of India. Bitsyyloan claims to use a proprietary credit scoring system called the Social Borrowing Quotient (SBQ).

Note: While Bitsyyloan claims to operate in the fintech sector, its terms and conditions do not explicitly state that it is an NBFC.

What is SBQ?

Social Borrowing Quotient – We are concerned with your present, not your past. Any brand born in the digital world must possess the qualities necessary to create a better space for digitally savvy individuals. We are all part of a constantly evolving digital community that profoundly impacts us in numerous ways.

Therefore, the desire to make our mark in the social world has led us to develop an advanced credit ranking system using big data analytics, AI, and predictive tools to calculate our customers’ Social Borrowing Quotient (SBQ). Traditional lending agencies and banks rely heavily on your past financial transactions, but we are interested in your present. The revolutionary approach of SBQ transforms how credit risk is calculated. It incorporates multiple data points, including mobile and social media presence, education, monthly income, and career experience. SBQ is an interactive platform that provides a comprehensive view of your creditworthiness.

Boost Loan App With Referral Code

Key features of Bitsyyloan

- Bitsyyloan provides short-term loans ranging from ₹5000 to ₹5 lakhs.

- The application process is primarily online with minimal paperwork.

- Bitsyyloan aims to transfer the loan amount to the user’s bank account as quickly as possible after approval.

- It primarily serves salaried individuals who earn at least ₹10,000 per month.

- Bitsyyloan is specifically designed for those who need money before their salary is credited; they can receive a loan from Bitsyyloan as an advance against their salary.

- It uses SBQ (Social Behavioral Quotient) for loan assessment.

- Bitsyyloan is an online platform; you can apply for a loan from the comfort of your home, anytime, anywhere, using your mobile phone.

Bitsyyloan – Eligibility

- The loan applicant must be an Indian citizen.

- The loan applicant must be over 18 years of age.

- The loan applicant must be currently employed.

- Minimum monthly salary of ₹10,000 is required.

- A mobile smartphone, bank account, PAN card, Aadhaar card, and other necessary documents are required.

Bitsyyloan application process

- First, download the Bitsyyloan App Or visit the Bitsyyloan website at https://www.bitsyyloan.com/apply-loan

- Login to Bitsyyloan App and enter the details

- Fill in all your basic information.

- Upload all your documents.

- Bitsyyloan offers an SBQ score that depends on your social media profile, education, salary, etc.

- Based on your SBQ score, you will be offered a loan limit between 5000 and 5 lakh.

- If the loan is approved, you will need to fill out the e-NACH mandate form.

- The loan amount will be transferred to your bank account.

For example:

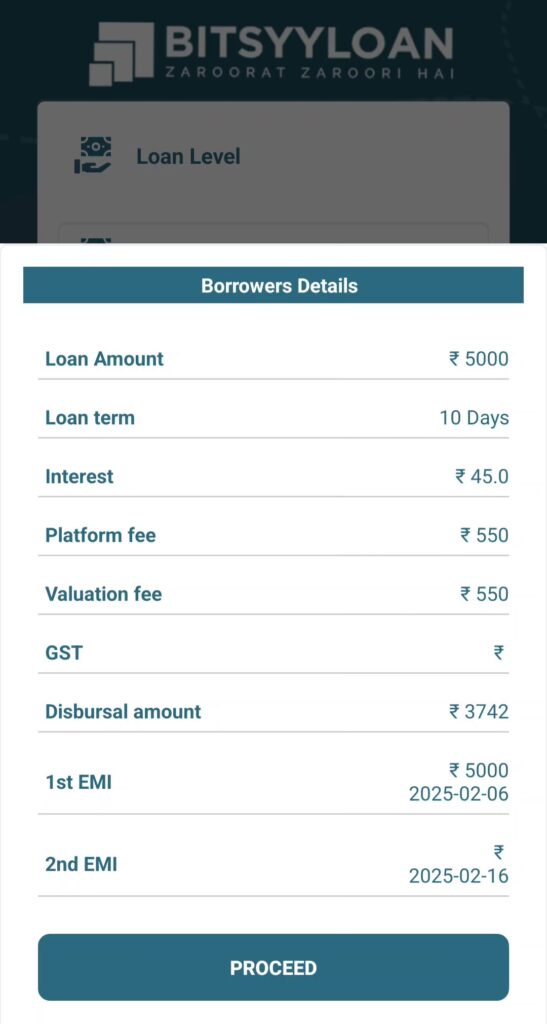

Interest Rate – 0% to 30% per annum depending on the product

Tenure – 61 days to 90 days

Processing Fees – Fees start from just ₹300. No membership or upfront fees are charged.

Example: If the loan amount is ₹10,000 and the interest is 20% per annum for a period of 61 days, then after deducting any other charges, the total cost of the loan at the time of repayment will be = ₹10,000 × 20% / 365 × 61 = ₹354, and the total repayment amount will be ₹10,358.

Note: This calculation is for illustrative purposes only. Interest and other charges depend on your credit history and profile.

FAQs

Who can apply for loan from BITSYYLOAN?

Any Indian citizen who is over 18 years of age, has proof of current employment, a monthly salary of ₹10,000 or more, and valid identity and address proof, can apply for a BITSYLOAN.

How much loan can I get from BITSYYLOAN?

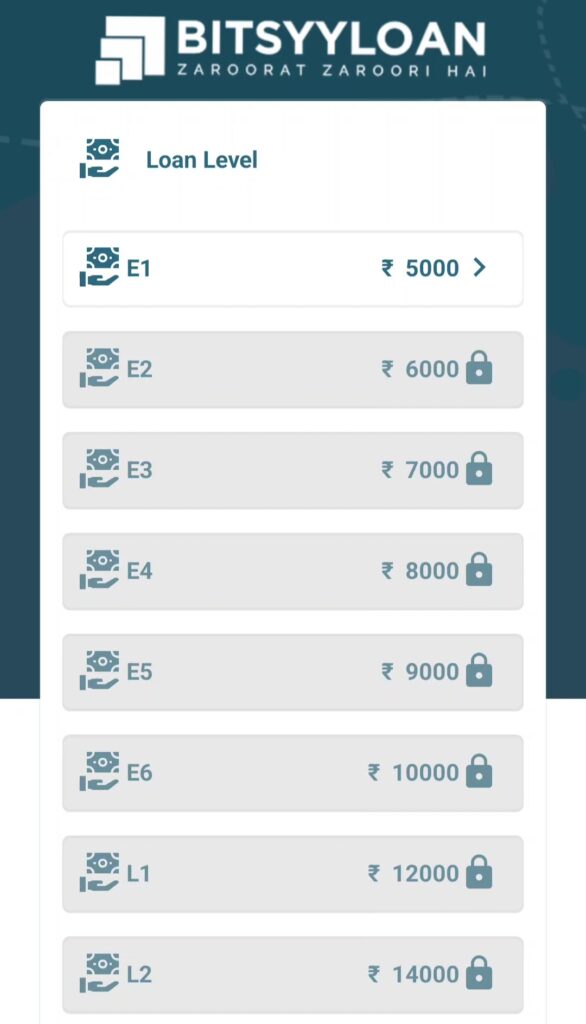

You can get a loan from BITSYYLOAN ranging from a minimum of ₹5,000 to a maximum of ₹5 lakhs. By making timely payments, you can progress from Level 1 to Level 13.

Can I reapply?

If you believe your application should be reviewed again, or if you feel there have been significant improvements since your last application, please reapply one month after your previous application was rejected.