This article will discuss Anytime Rupee Loan. Anytime Rupee states that its mission is to empower individuals who face difficulties obtaining loans from traditional financial institutions. Whether it’s for essential medical expenses, bills, or urgent purchases, Anytime Rupee offers personal loans ranging from ₹2,000 to ₹30,000. Its aim is to assist those who lack access to conventional banking facilities. However, if you are considering taking a loan from Anytime Rupee, it is your responsibility to thoroughly analyze the service. Please read this entire article.

What is Anytime Rupee?

Anytime Rupee is an online loan platform that provides personal loans ranging from ₹2,000 to ₹30,000 through its RBI-registered NBFC partner (Finagle Financial Services Private Limited). Anytime Rupee Loan states that it serves individuals with a consistent income but who do not have salary slips, as these individuals often face difficulties in obtaining loans. Anytime Rupee aims to provide quick loans to such individuals.

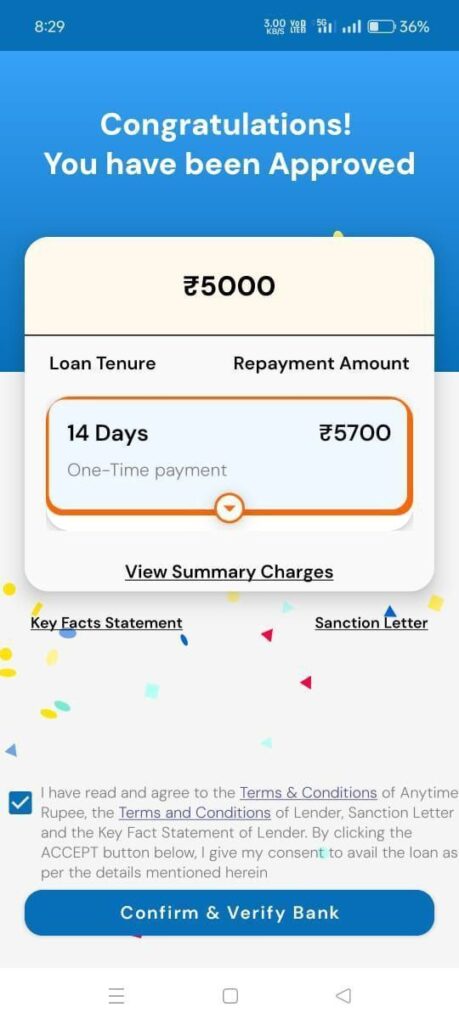

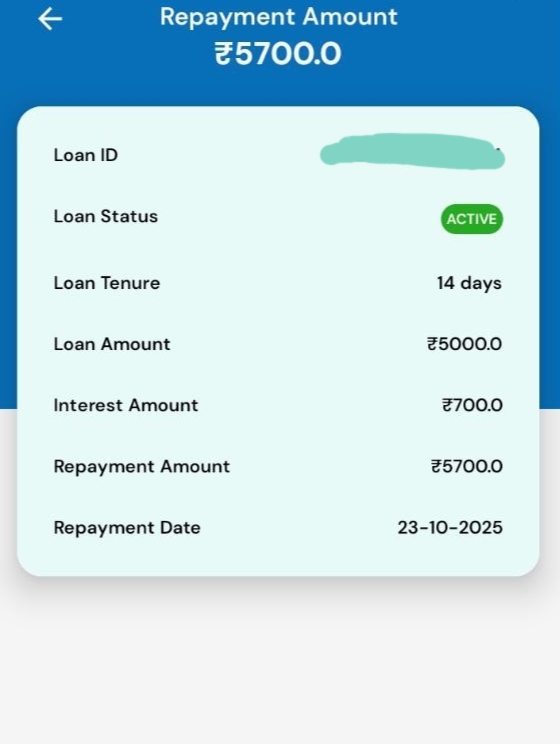

Note:- However, after taking the loan, we found out that a ₹5,000 loan is only given for 14 days, of which ₹4,250 is credited to your bank account, and you have to repay ₹5,700 after 14 days.

Why choose Anytime Rupee Loan?

- Loan users can instantly get a loan of ₹2000 to ₹30000 for all their needs, such as medical emergencies, urgent travel, household expenses, school fees, unexpected bills, or any unforeseen expenses.

- Get instant loan approval with a completely digital process and receive the loan in just a few minutes.

- Anytime Rupee says we provide completely secure loans, eliminating the need for collateral.

- Apply for a loan with minimal documentation – only your PAN card, Aadhaar card, and basic details are required.

- Choose a repayment plan according to your needs.

- You don’t need any collateral or guarantee for an Anytime Rupee loan.

- For your security, Anytime Rupee is protected with bank-grade encryption.

- You can apply for an Anytime Rupee loan 24/7 from the comfort of your home.

Anytime Rupee Loan Eligibility and Criteria

- The loan applicant must be an Indian citizen.

- The applicant’s age should be between 21 and 60 years.

- Salaried individuals, small business owners, or anyone with a source of income can apply.

- The applicant must have a source of income.

- The applicant must have all KYC documents.

- The loan applicant must have an active bank account.

- A good CIBIL score is required.

Boost Loan App With Referral Code

Anytime Rupee Loan application process

- First, download the Anytime Rupee Loan App.

- You can also visit the Anytime Rupee Loan website: https://anytimerupee.com/

- Then, verify your mobile number.

- Fill in your basic information.

- Upload all KYC documents.

- Choose the loan amount and loan tenure.

- Submit the loan application form and wait for loan approval. This may take up to 30 minutes.

- After loan approval, sign the loan agreement.

- The loan amount will then be transferred to your bank account.

Anytime Rupee Loan: Example

If you take a loan of ₹5000 from the Anytime Rupee loan app, you can see the details below.

- Loan Amount: ₹5,000

- Loan Tenure: 14 days

- Interest Amount: ₹700

- Processing Fee: ₹750

- Bank Disbursement Amount: ₹4,250

- Loan EMI: one time repyment

- Total Repayment Amount: ₹5,700

Anytime Rupee Loan Real Or Fake

As we know, according to the Anytime Rupee Loan app, it provides personal loans ranging from ₹2,000 to ₹30,000 through its RBI-registered NBFC partner (Finagle Financial Services Private Limited), with a claimed loan tenure of 62 to 90 days. However, after taking the loan, we found out that a ₹5,000 loan is only given for 14 days, of which ₹4,250 is credited to your bank account, and you have to repay ₹5,700 after 14 days. Anytime Rupee Loan follows bank-grade encryption standards for your security and is completely safe.

Note:- This article is for informational purposes only. If you decide to take a loan from the Anytime Rupee loan app, please use your own discretion.

FAQs

How much loan can I get from Anytime Rupee?

Anytime provides loans ranging from ₹2000 to ₹30000. If you repay your loan on time, your eligibility may increase over time.

How long does the Anytime Rupee Loan application process take?

According to the Anytime Rupee Loan App, they strive to complete the loan process within a few hours, and most loans are processed in less than 30 minutes.

Is Anytime Rupee Loan safe?

Yes, they use advanced encryption and data security measures to protect your information. Anytime Rupee never shares your personal data or credit profile with any third party.