Digi Credit Loan: As we know, taking a loan for monetary needs has become quite easy. In today’s digital age, with the help of mobile apps, one can apply for a loan from home. The name of one such loan app is Digi Credit Loan. Here, one can take a loan from ₹5000 to ₹75000. The tenure for Digi Credit Loan is 365 days. However, DIGI Credit is an Advance Salary Loan. If you need money before getting your salary, then Digi Credit Loan can be used. But it is mandatory to analyze it before taking Digi Credit Loan.

What is DigiCredit?

Digi Credit is an online digital loan platform that offers salary advance loan from ₹5000 to ₹75000 through its partner (DSG Investments Private Limited). The loan tenure is 365 days. Salaried individuals can apply for this loan.

Digi Credit Loan Eligibility and Criteria

- The loan applicant must be an Indian resident.

- Must be a salaried employee.

- Applicant must be between 21 and 60 years of age.

- Salary must be at least ₹20,000 per month.

- Loan applicant’s salary must be credited to their bank account.

- Loan applicant must have a salary bank account.

- Must have a good CIBIL score.

Documents for DigiCredit Loan

- Aadhaar card and mobile number must be linked.

- PAN card must be available.

- Income proof must be available (pay slip or bank statement).

- Salary must be credited to the bank account.

- An active bank account must be available.

- Selfie photo

Digi Credit Loan Benefits and Features

- Digi Credit Loan users can avail of a personal loan ranging from ₹5,000 to ₹75,000 for 365 days to meet their needs.

- Digi Credit Loan is specifically designed for those who need money before receiving their salary.

- You can apply for this loan from the comfort of your home using your mobile phone; it is 100% online.

- You don’t need any guarantees or collateral for Digi Credit Loan.

- You can withdraw money from Digi Credit into your bank account within minutes.

- To ensure your personal information is protected, Digi Credit Loan adheres to strict data privacy and encryption standards.

- Digi Credit offers customers a track record of no hidden charges.

DIGI Credit Loan Real Or Fake

As we know, Digi Credit is a fintech loan institution that provides salary advance loans ranging from ₹5000 to ₹75000 through DSG Investments Private Limited. DSG Investments Private Limited is an RBI registered NBFC that provides loans. This loan is especially for those who need money before receiving their salary. They can avail salary advance loans using DIGI Credit.

For example

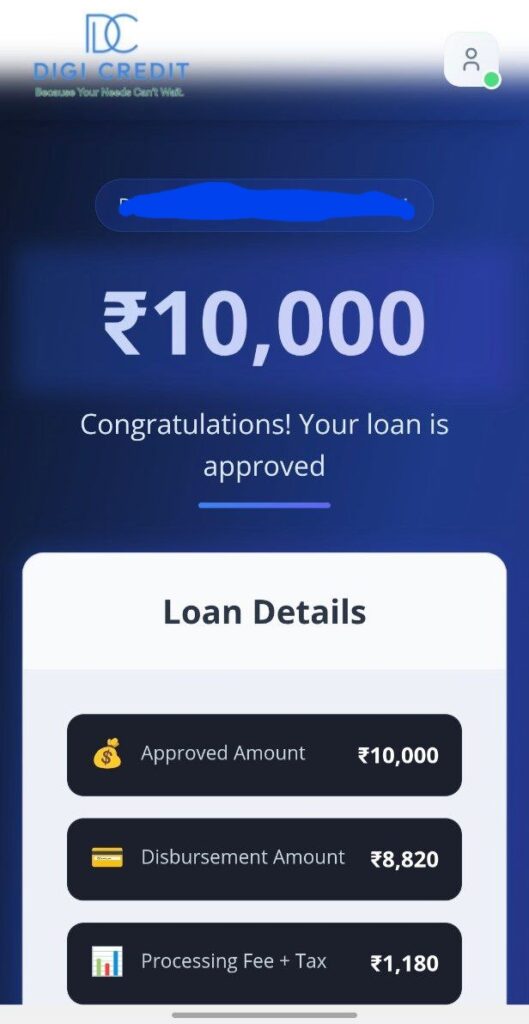

If you take a loan of ₹25000 from DigiCredit with a loan tenure of 12 months, you can see the calculation below.

- Loan Amount: ₹25,000

- Loan Tenure: 12 Months

- Interest Amount: ₹5,144

- Processing Fee: ₹1,250

- Bank Disbursement Amount: ₹23,750

- APR: 46.44%

- Loan Cost: ₹6,394

- EMI: ₹2,512

- Total Repayment Amount: ₹30,144

Apply for DIGI Credit Loan

- First, visit the website https://digicredit.in/ and click on “Register with your mobile number.”

- Fill in your basic information and upload your KYC documents.

- Select the loan amount and loan term you wish to apply for.

- Submit the loan application form and wait for approval.

- After submitting your application, you may receive a call from Digi Credit for loan verification.

- After verification is complete, you will be provided with a loan offer.

- After loan approval, sign the loan agreement.

- The loan amount will then be transferred to your bank account.

Note: Although some user reviews and complaints indicate that DIGI Credit Loan is an advance salary loan, it is only available to salary users.

It is your responsibility to calculate this before taking out this loan. The charges for advance salary loans can be high.

FAQs

How much loan can I get from DIGI Credit?

You can get loan offers ranging from ₹5000 to ₹75000 depending on your income, credit score, profile and eligibility

Is DIGI Credit Loan safe?

Digi Credit follows strict data privacy and security regulations to ensure your personal information is safe.

Is DIGI Credit Loan registered with RBI?

According to DIGI Credit, it provides loans through its NBFC partner {DSG Investments Private Limited} which is registered with RBI.