In this article, we will learn about PFIL Finance Loan. If you need a loan and are a student or are considering taking a personal loan using your Aadhaar card, then PFIL Finance Loan could be a great option for you. You can get a personal loan ranging from ₹1000 to ₹50000 from PFIL Finance Loan. This loan application is specifically designed for salaried individuals and students. PFIL Finance Loan is a secure, paperless, online digital lending platform registered with the RBI.

What is PFIL Finance?

PFIL Finance is a digital lending platform registered with the RBI (Reserve Bank of India) and operated by NBFC (Pooja Finstock International Limited). It offers personal loans ranging from ₹1000 to ₹50000 with a loan tenure of 91 to 365 days. The annual interest rate can range from 18% to 28%. PFIL Finance loans are available online 24/7, and you can apply for a loan anytime using your mobile phone.

Features of PFIL Finance Loan

- Loan disbursement by RBI registered NBFCs

- 100% digital and paperless loan facility

- Real-time KYC and bank verification

- Auto debit setup for EMI payments

- No hidden charges

- No security deposit required

PFIL Finance Loan Eligibility and Criteria

- The loan applicant must be an Indian citizen.

- The applicant’s age should be between 21 and 55 years.

- The applicant must be salaried or self-employed with a regular income.

- The credit score should be 700 or higher.

- The applicant must have an active bank account with proof of income.

PFIL Finance Loan Documents

- Aadhaar card linked to your mobile number is required.

- PAN card is required.

- Salary bank account is required.

- Bank statement or salary slips or ITR for the last 3 to 6 months is required.

- A photo selfie is required.

PFIL Finance Loan Real Or Fake

As we have learned in this article, PFIL Finance Loan, offered by Pooja Finstock International Limited, provides small personal loans ranging from ₹1000 to ₹50000 with a loan tenure of 91 to 365 days. Salaried individuals, self-employed individuals, and students can apply for this loan. The interest rate on the loan amount can range from 18% to 28%.

Regarding its legitimacy, this application is genuine and registered with the RBI. It provides loans through an NBFC (Pooja Finstock International Limited). If you apply for a loan through this application, your data is 100% secure. However, for a loan on this application, your credit score must be 700 or higher, and you will have to pay a charge of ₹51 to check your credit score.

PFIL Finance Loan Application Process

To apply for a loan, follow the steps below:

- Download the PFIL Finance Loan App

- Verify with your mobile number or email address

- Fill in some basic details and upload the required documents

- Wait a few minutes for loan approval

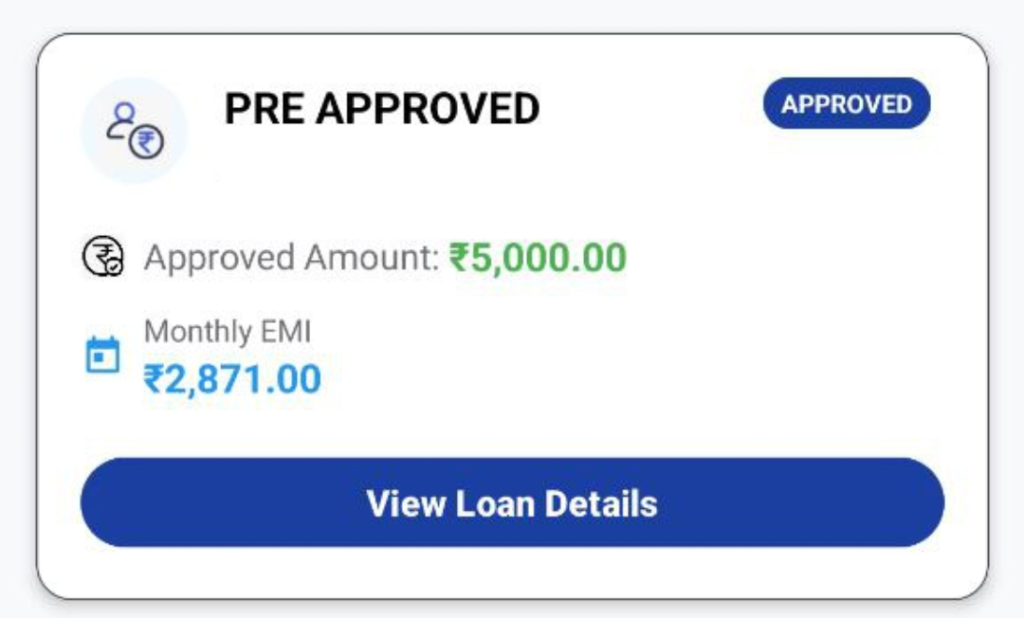

- View the loan offer

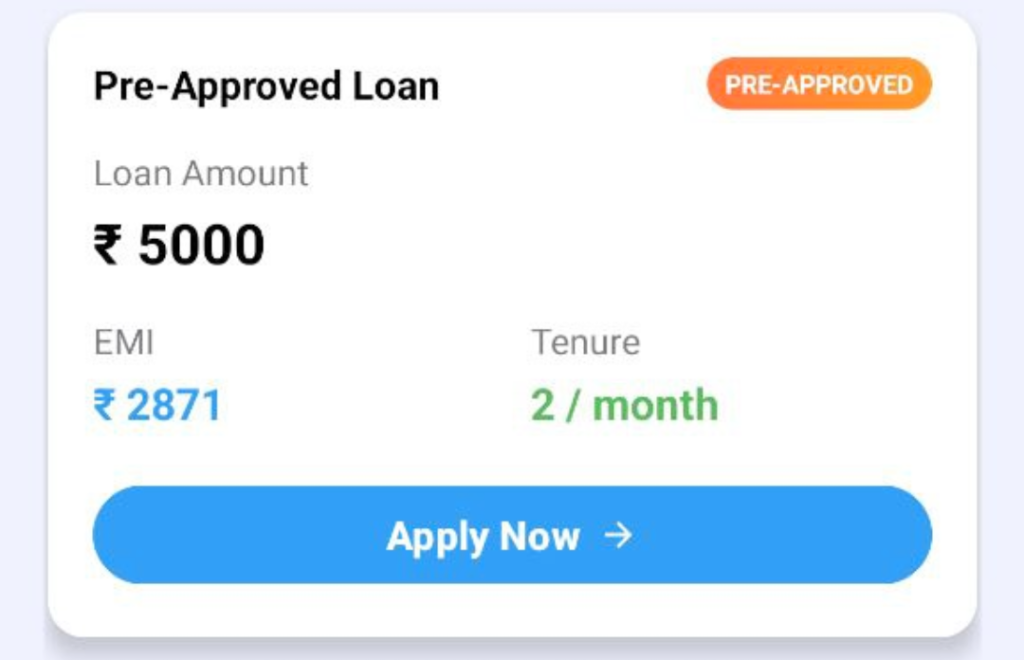

- Choose the loan amount and loan tenure

- Accept the loan agreement

- The loan amount will be transferred to your bank account

For example

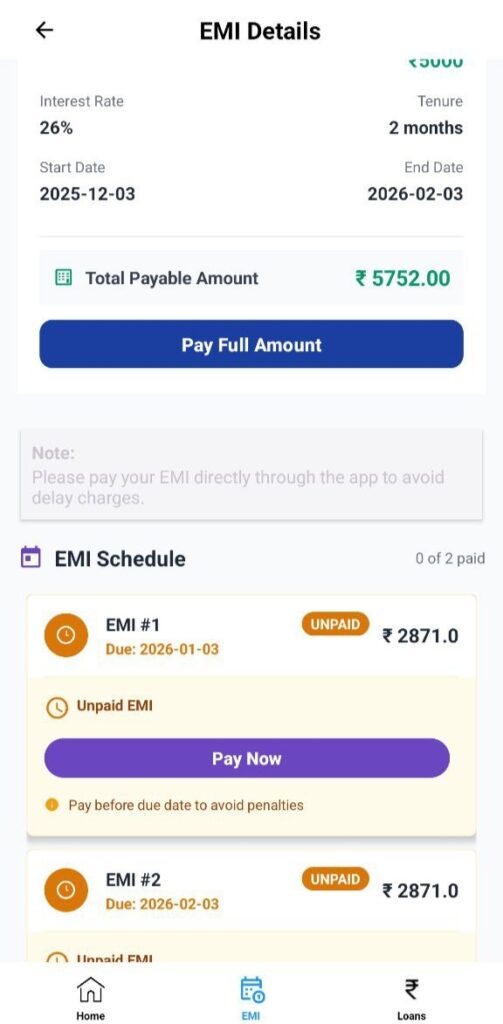

If you take a loan of ₹5000 from PFIL Finance Loan with a loan tenure of 60 days, you can see the calculation below.

- Loan Amount: ₹5,000

- Loan Tenure: 2 months

- Bank Disbursal Amount: ₹4,454

- EMI Amount: ₹2,871

- Processing Fee: ₹546

- Interest Rate: 26%

- Total Repayment Amount: ₹5,752

Note: Actual interest rates and fees may depend on your loan eligibility and verification. This may vary depending on your profile.

FAQs

1. Is PFIL Finance Loan safe?

The PFIL Finance Loan App is registered with the RBI and designed with security in mind, incorporating measures such as data protection and compliance with legal regulations. However, it’s important to be aware of the inherent risks associated with any financial service. The loan is provided by Pooja Finstock International Limited, an NBFC registered with the Reserve Bank of India, which claims to be 100% secure.

2. How much loan can be taken from PFIL Finance?

PFIL Finance claims to offer loans ranging from ₹1000 to ₹50000 with a loan tenure of 91 to 365 days.

3. What is the interest rate on a PFIL Finance Loan?

The interest rate charged by PFIL Finance can range from 18% to 28% per annum, although this may vary depending on your profile and eligibility.