If you need a loan of ₹5000, and you are an employee looking for a small loan for pocket money, there are various companies in India where you can get an instant ₹5000 loan with instant approval. However, in this article, we will learn about the Instant Funds loan app. With Instant Funds, you can get a loan ranging from ₹5000 to ₹50000. This loan company is especially for students and salaried employees. If you are an employee, you can get a ₹5000 loan with instant approval from Instant Funds.

What is Instant Funds?

Instant Funds is a digital lending platform that provides personal loans ranging from ₹5,000 to ₹50,000 through its NBFC partner (B P Securities India Private Limited), a non-banking financial institution registered with the Reserve Bank of India.

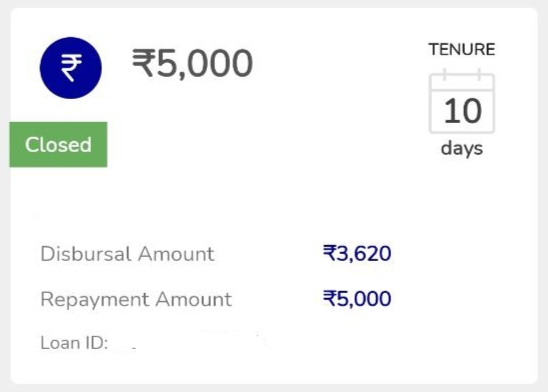

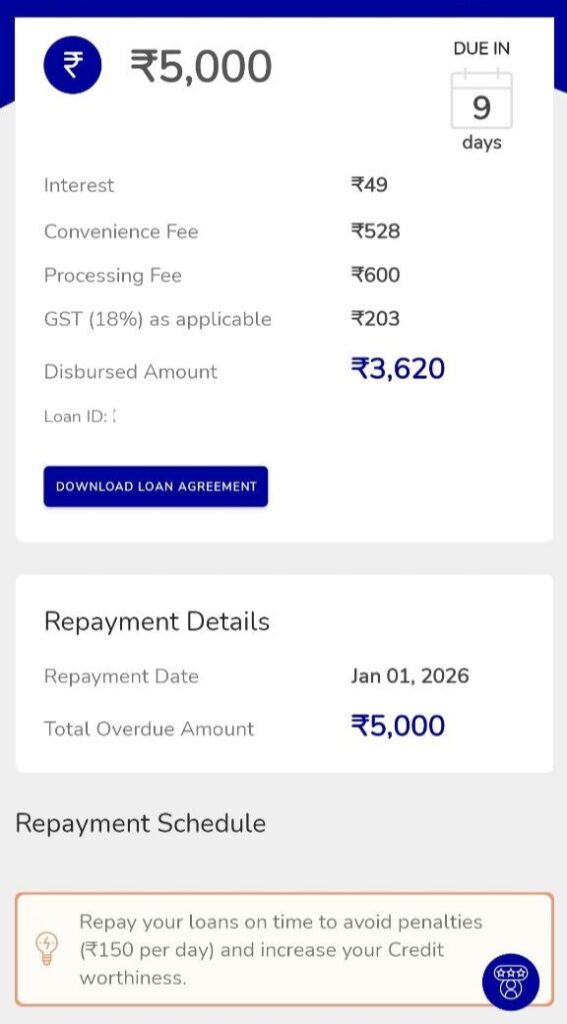

Note: However, when you apply for a loan for the first time, you will only be able to borrow ₹5,000, with a repayment period of 10 days. Out of the ₹5,000 loan amount, ₹3,620 will be deposited into your bank account. You will have to repay ₹5,000 after 10 days.

For example:

- Loan amount: ₹5000

- Loan tenure: 10 days

- Processing fee: ₹600

- Convenience fee: ₹528

- GST: ₹203

- Bank disbursement amount: ₹3620

- Total repayment: ₹5000

How to get a 500 instant loan?

Instant Funds Loan Features

- You can get an instant loan of ₹5000 immediately.

- The money will be credited to your bank account within 30 minutes of completing the process.

- There are no hidden fees.

- No guarantor or collateral is required.

- Whether you are salaried or self-employed, you can get an instant loan with minimal documentation.

- Instant Funds Loan has an excellent customer support team.

- You can apply for a loan with Instant Funds Loan 24/7 from anywhere in India.

- To get an instant loan, you can complete the online application process from the comfort of your home using your mobile phone. No paperwork is required.

- We follow strict data privacy and encryption standards to ensure your personal information remains secure.

Instant Funds Loan Eligibility and Criteria

- The applicant must be an Indian citizen.

- The loan applicant must be 21 years of age or older.

- Salaried or self-employed individuals can apply.

- Salaried individuals must have a monthly income of ₹15,000 or more.

- Self-employed individuals can avail a personal loan with a monthly income of ₹25,000 or more.

- The loan applicant must have an active bank account.

Required Documents

- Aadhaar Card

- PAN Card

- Bank statement for the last 3 months

- Joining letter, salary slip, or business and company details

How to get instant loan approval for ₹5000

Follow all the steps below to get instant approval for a ₹5000 loan.

- First, download the Instant Funds Loan App

- Mobile Number

- Full Name, Date of Birth and Gender

- PAN Card

- Type of Employment and Company Name

- Monthly Income

- Address Proof (Permanent and Current Address)

- Selfie

- Bank Statement and Proof of Employment (Salary Slip / Office ID / UAN – for salaried employees)

- Reference Contacts

- Payment Bank Account Details

- eNACH / UPI e-mandate

- Loan Amount Bank Disbursement

About Instant Funds

Instant Funds Loan App is operated by B P Securities India Private Limited, a trusted NBFC registered with the Reserve Bank of India. Any salaried or self-employed individual across India, aged 21 years or older, can apply for a ₹5000 loan with instant approval. Instant Funds Loan App provides loans to individuals whose salaries are credited to their bank accounts. You can use the Instant Funds Loan App if you need money before your salary is credited.

FAQs

How much loan can I get from Instant Funds?

With Instant Funds, you can get a personal loan of ₹5000 to ₹50000, but the first loan will be ₹5000. Your loan limit will increase with timely repayments.

What documents are required for instant approval of a 5000 loan?

Aadhaar card, PAN card, and three months of bank statements.

How can employees in India get instant approval for a ₹5000 loan?

In India, salaried employees can get instant loan approval of ₹5000 through instant funds loan apps. How can you get instant approval for a ₹5000 loan?